The call is 25% short Emerging Markets and 75% long spx.

Will trade at 70%. will update changed to short China

Friday, December 31, 2010

Thursday, December 30, 2010

Wednesday, December 29, 2010

Thursday's Call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 80%. will update. call stands.

Will trade at 80%. will update. call stands.

Tuesday, December 28, 2010

Wednesday's call.

The call is 25% long Emerging Markets and 75% long rut.

Will trade at 80%. will update call stands

Will trade at 80%. will update call stands

Monday, December 27, 2010

Tuesday's Call.

The call is 25% short Emerging Markets and 75% long rut.

Will trade at 80%. will update. call is long EM. will trade at 70%

Will trade at 80%. will update. call is long EM. will trade at 70%

Thursday, December 23, 2010

Monday's 12-27-10 call.

The call is 25% short China and 75% long spx.

Will trade at 80%. will update call stands.

Will trade at 80%. will update call stands.

Wednesday, December 22, 2010

Thursday's Call.

The call is 25% short Emerging Markets and 75% long spx.

Will trade at 70%. will update.call stands

Will trade at 70%. will update.call stands

Tuesday, December 21, 2010

Wednesday's call.

The call is 25% short Emerging Markets and 75% long spx.

Will trade at 70%. will update.call stands.

Will trade at 70%. will update.call stands.

Monday, December 20, 2010

Tuesday's Call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 60%. will update. call stands.

Will trade at 60%. will update. call stands.

Friday, December 17, 2010

Thursday, December 16, 2010

Friday's call.

The call is 25% short Emerging Markets and 75% long spx.

Will trade at 90%. will update.

Will trade at 90%. will update.

Wednesday, December 15, 2010

Tuesday, December 14, 2010

Wednesday's call.

The call is 25% long china and 75% long rut.

Will trade at 80%. will update. now long ndx will trade at 50%

Will trade at 80%. will update. now long ndx will trade at 50%

Monday, December 13, 2010

Tuesday's Call.

The call is 25% long Emerging Markets and 75% short ndx.

Will trade at 90%. will update. call is now short EM will trade at 70%.

Will trade at 90%. will update. call is now short EM will trade at 70%.

Friday, December 10, 2010

Monday's 12-13-10 call.

The call is 25% short Emerging Markets and 75% long spx.

Will trade at 70%. will update.call stands.

Will trade at 70%. will update.call stands.

Thursday, December 9, 2010

Friday's call.

The call is 25% short Emerging Markets and 75% long spx.

Will trade at 70%. will update call stands

Will trade at 70%. will update call stands

Wednesday, December 8, 2010

Thursday's Call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 70%. will update call is now short spx.

Will trade at 70%. will update call is now short spx.

Tuesday, December 7, 2010

Wednesday's call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 70%. will update switched to short EM and 90%

Will trade at 70%. will update switched to short EM and 90%

Monday, December 6, 2010

Tuesday's Call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 70%. will update call has switched to short EM and 80% trade.

Will trade at 70%. will update call has switched to short EM and 80% trade.

Friday, December 3, 2010

Monday's 12-06-10 call.

The call is 25% long Emerging Markets and 75% long spx.

Will trade at 90%. will update It has changed to short spx.

Will trade at 90%. will update It has changed to short spx.

Thursday, December 2, 2010

Friday's call.

The call is 25% long Emerging Markets and 75% short ndx.

Will trade at 90%. will update. call stands.

Will trade at 90%. will update. call stands.

Wednesday, December 1, 2010

Thursday's Call.

The call is 25% short Emerging Markets and 75% short spx.

Will trade at 70%. will update. call stands.

Will trade at 70%. will update. call stands.

Tuesday, November 30, 2010

Wednesday's call.

The call is 35% short Emerging Markets and 65% long spx.

Will trade at 70%. will update. will trade at 80%

Will trade at 70%. will update. will trade at 80%

Monday, November 29, 2010

Tuesday's Call.

The call is 35% long Emerging Markets and 65% long ndx.

Will trade at 70%. will update. call stands.

Will trade at 70%. will update. call stands.

Friday, November 26, 2010

Monday's 11-29-10 call.

The call is 35% long Emerging Markets and 65% long ndx.

Will trade at 70%. Actually it ended up short ndx for Monday.

Will trade at 70%. Actually it ended up short ndx for Monday.

Wednesday, November 24, 2010

Friday's call.

The call is 35% long Emerging Markets and 65% short spx.

Will trade at 90%. will update. call stands. have a great Thanks giving.

Will trade at 90%. will update. call stands. have a great Thanks giving.

Tuesday, November 23, 2010

Wednesday's call.

The call is 35% short China and 65% long ndx.

Will trade at 90%. will update. call stands.

Will trade at 90%. will update. call stands.

Monday, November 22, 2010

Tuesday's Call.

The call is 35% long China and 65% long ndx.

Will trade at 50%. will update. call stands. may trade more than 50%....70%.

Will trade at 50%. will update. call stands. may trade more than 50%....70%.

Friday, November 19, 2010

Monday's 11-22-10 call.

The call is 35% long China and 65% long ndx.

Will trade at 70%. will update. call stands.

Will trade at 70%. will update. call stands.

Thursday, November 18, 2010

Friday's call.

The call is 35% short Emerging Markets and 65% short rut.

Will trade at 70%. will update. call stands.

Will trade at 70%. will update. call stands.

Wednesday, November 17, 2010

Thursday's Call.

The call is 35% long Emerging Markets and 65% short spx.

Will trade at 100%. will update. call stands.

Will trade at 100%. will update. call stands.

Tuesday, November 16, 2010

Wednesday's call.

The call is 35% short Emerging Markets and 65% long spx.

Will trade at 80%. will update. call stands.

Will trade at 80%. will update. call stands.

Monday, November 15, 2010

Tuesday's Call.

The call is 35% long Emerging Markets and 65% long spx.

Will trade at 70%. will update. call stands.

Will trade at 70%. will update. call stands.

Friday, November 12, 2010

Monday's 11-15-10 call.

the call is 65% short emerging Markets and 35% short ndx.

I will trade at 60%. will update. will change to 35% short EM and 65% short ndx.

I will trade at 60%. will update. will change to 35% short EM and 65% short ndx.

Thursday, November 11, 2010

Friday's call.

the call is 65% short emerging Markets and 35% short ndx.

I will trade at 70%. will update. call stands.

I will trade at 70%. will update. call stands.

Wednesday, November 10, 2010

Thursday's Call.

the call is 65% long emerging Markets and 35% short spx.

I will trade at 70%. will update. call stands.

I will trade at 70%. will update. call stands.

Tuesday, November 9, 2010

Wednesday's call.

the call is 65% long emerging Markets and 35% short rut.

I will trade at 70%. call may change near close...will update in few minutes. call is long EM and long spx.

I will trade at 70%. call may change near close...will update in few minutes. call is long EM and long spx.

Monday, November 8, 2010

Tuesday's Call.

the call is 65% long emerging Markets and 35% short rut.

I will trade at 90%. will update. call stands.

I will trade at 90%. will update. call stands.

Friday, November 5, 2010

Monday's 11-08-10 call.

the call is 65% long emerging Markets and 35% long spx.

I will trade at 70%.

I will trade at 70%.

Thursday, November 4, 2010

Wednesday, November 3, 2010

Thursday's Call.

the call is 65% short emerging Markets and 35% short spx.

I will trade at 60%. Will update as this call will likely change before close. call stands.

I will trade at 60%. Will update as this call will likely change before close. call stands.

Tuesday, November 2, 2010

Returns for week ending 10-29-10.

New system is performing well so will personally follow its calls. I am also posting a futures trading system on Collective2, which will hopefully generate some cash outside my IRA. It is named E-Mini Maxi.

Wednesday's call.

the call is 65% short emerging markets and 35% long spx.

I will trade at 90%. will update. call stands.

I will trade at 90%. will update. call stands.

Monday, November 1, 2010

Tuesday's Call.

The call is 65% long eem and 35% short spx.

I will trade at 80%. Will update. call stands.

Am posting both calls again as returns have been better using both calls.

I will trade at 80%. Will update. call stands.

Am posting both calls again as returns have been better using both calls.

Friday, October 29, 2010

Thursday, October 28, 2010

Wednesday, October 27, 2010

Tuesday, October 26, 2010

Monday, October 25, 2010

Friday, October 22, 2010

Thursday, October 21, 2010

Wednesday, October 20, 2010

Thursday's Call.

The call is short spx. will update. call stands.

I will trade at 50%. Today did rebound....so am on the fence as to tomorrows direction.

I will trade at 50%. Today did rebound....so am on the fence as to tomorrows direction.

Tuesday, October 19, 2010

Wednesday's call.

The call is long spx.

I will trade at 50%. Not too convinced market will rebound tomorrow.

I will trade at 50%. Not too convinced market will rebound tomorrow.

Monday, October 18, 2010

Friday, October 15, 2010

Thursday, October 14, 2010

Wednesday, October 13, 2010

Thursday's Call.

The call is long spx.

I will trade at 30%. Call may change near close, will update. call stands.

I will trade at 30%. Call may change near close, will update. call stands.

Returns for week ending 10-08-10.

The "new system" has out performed the domestic calls which I decided to follow the last two weeks. It is par for the course that when the grass appears greener on the other side and you jump then it will whipsaw. I will continue to post one call for a period as I work to improve aspects of the new system.

Tuesday, October 12, 2010

Monday, October 11, 2010

Friday, October 8, 2010

Thursday, October 7, 2010

Wednesday, October 6, 2010

Tuesday, October 5, 2010

Monday, October 4, 2010

Friday, October 1, 2010

Thursday, September 30, 2010

Wednesday, September 29, 2010

Tuesday, September 28, 2010

Wednesday's call.

the call is long spx.

I will trade at 70%. will update. the call has changed to short rut.

I will trade at 70%. will update. the call has changed to short rut.

Monday, September 27, 2010

Friday, September 24, 2010

Thursday, September 23, 2010

Wednesday, September 22, 2010

Tuesday, September 21, 2010

Wednesday's call.

The call is 70% short rut. For tracking purposes this will be trading 2x of the indicated index or ETF.

Will update. call stands.

Will update. call stands.

Monday, September 20, 2010

Tuesday's Call.

The call is 70% short spx.

Due to lackluster performance of new system., I will be trading one system for a period.

Due to lackluster performance of new system., I will be trading one system for a period.

Friday, September 17, 2010

Monday's 9-20-10 call.

The call is 35% short emerging markets and 65% long spx.

I will trade at 90%.

The domestic call has the bias. will update call stands.

I will trade at 90%.

The domestic call has the bias. will update call stands.

Thursday, September 16, 2010

Friday's call.

The call is 35% long emerging markets and 65% short spx.

I will trade at 70%.

The domestic call has the bias. will update. call stands.

I will trade at 70%.

The domestic call has the bias. will update. call stands.

Wednesday, September 15, 2010

Thursday's Call.

The call is 35% long emerging markets and 65% short spx.

I will trade at 80%.

The domestic call has the bias. will update. call stands

I will trade at 80%.

The domestic call has the bias. will update. call stands

Tuesday, September 14, 2010

Wednesday's call.

The call is 35% long emerging markets and 65% long spx.

I will trade at 40%.

The domestic call has the bias. will update call stands.

I will trade at 40%.

The domestic call has the bias. will update call stands.

Monday, September 13, 2010

Tuesday's Call.

The call is 35% long emerging markets and 65% long spx.

I will trade at 60%.

The domestic call has the bias. for the record

I will trade at 60%.

The domestic call has the bias. for the record

Friday, September 10, 2010

Monday's call.

The call is 35% short emerging markets and 65% long spx.

I will trade at 70%.

The domestic call has the bias. will update call stands.

I will trade at 70%.

The domestic call has the bias. will update call stands.

Thursday, September 9, 2010

Friday's call.

The call is 35% short emerging markets and 65% long spx.

I will trade at 40%.

The domestic call has the bias. will update. call may change to short-short. yes it is short-short will trade at 70%.

I will trade at 40%.

The domestic call has the bias. will update. call may change to short-short. yes it is short-short will trade at 70%.

Wednesday, September 8, 2010

Thursday's Call.

The call is 35% long emerging markets and 65% short spx.

I will trade at 80%.

The domestic call has the bias. call may change to long- long. yes, it has, will trade at 60%

I will trade at 80%.

The domestic call has the bias. call may change to long- long. yes, it has, will trade at 60%

Tuesday, September 7, 2010

Friday, September 3, 2010

Tuesday's Call.

the call is 65% short emerging markets and 35% long spx.

I will trade at 90%.

The domestic call has the bias.will update. call stands.

I will trade at 90%.

The domestic call has the bias.will update. call stands.

Thursday, September 2, 2010

Friday's call.

the call is 35% short emerging markets and 65% short spx.

I will trade at 70%.

The domestic call has the bias.will update. the call has changed to long EM and long spx.

I will trade at 70%.

The domestic call has the bias.will update. the call has changed to long EM and long spx.

Wednesday, September 1, 2010

Thursday's Call.

the call is 35% short emerging markets and 65% long spx.

I will trade at 100%.

The domestic call has the bias.

I will trade at 100%.

The domestic call has the bias.

Tuesday, August 31, 2010

Wednesday's call.

the call is 35% short emerging markets and 65% long spx.

I will trade at 70%.

The domestic call has the bias.will update the call is now long emerging also. will trade at 60%

I will trade at 70%.

The domestic call has the bias.will update the call is now long emerging also. will trade at 60%

Monday, August 30, 2010

Tuesday's Call.

the call is 35% short emerging markets and 65% long spx.

I will trade at 70%.

The domestic call has the bias.will update call stands.

I will trade at 70%.

The domestic call has the bias.will update call stands.

Friday, August 27, 2010

Monday's 8-30-10 call.

the call is 35% long emerging markets and 65% short spx.

I will trade at 90%.

The domestic call has the bias. will update. call stands

I will trade at 90%.

The domestic call has the bias. will update. call stands

Thursday, August 26, 2010

Friday's call.

the call is 65% short emerging markets and 35% shortspx.

I will trade at 70%.

The overseas call has the bias

I will trade at 70%.

The overseas call has the bias

Wednesday, August 25, 2010

Thursday's Call.

the call is 65% long emerging markets and 35% long spx.

I will trade at 70%.

The overseas call has the bias

the overseas call has the bias will update. call is now short spx. will again check at 3:50 it is back to long spx.

I will trade at 70%.

The overseas call has the bias

the overseas call has the bias will update. call is now short spx. will again check at 3:50 it is back to long spx.

Tuesday, August 24, 2010

Wednesday's call.

the call is 65% long emerging markets and 35% long spx.

I will trade at 70%.

the overseas call has the bias. will update call has changed to short spx.and 80% trade

I will trade at 70%.

the overseas call has the bias. will update call has changed to short spx.and 80% trade

Monday, August 23, 2010

Tuesday's Call.

the call is 65% short emerging markets and 35% long spx.

I will trade at 70%.

the overseas call has the bias

I will trade at 70%.

the overseas call has the bias

Friday, August 20, 2010

Monday's 8-23-10 call.

the call is 65% short emerging markets and 35% short spx.

I will trade at 60%.

the overseas call has the bias.will update call stands

I will trade at 60%.

the overseas call has the bias.will update call stands

Thursday, August 19, 2010

Friday's call.

the call is 65% short emerging markets and 35% long spx.

I will trade at 40%.

the overseas call has the bias.

I will trade at 40%.

the overseas call has the bias.

Wednesday, August 18, 2010

Thursday's Call.

the call is 65% short emerging market s and35% short spx.

I will trade at 60%.

the overseas call has the bias. will update call stands.

I will trade at 60%.

the overseas call has the bias. will update call stands.

Tuesday, August 17, 2010

Wednesday's call.

the call is 65% short Emerging markets and 35% short spx.

I will trade at 60%.

The overseas call has the bias.

I will trade at 60%.

The overseas call has the bias.

Monday, August 16, 2010

Tuesday's Call.

The call is 60% long emerging markets and 40% long spx.

I will trade at 50%.

The overseas call has the bias. will update.

I will trade at 50%.

The overseas call has the bias. will update.

Friday, August 13, 2010

Monday's 8-16-10 call.

the call is 60% short Emerging markets and 40% short spx.

I will trade at 60%.

the overseas call has the bias.

I will trade at 60%.

the overseas call has the bias.

Thursday, August 12, 2010

Friday's call.

the call is 40% long Emerging markets and 60% long spx.

I will trade at 30%.

The overseas call has the bias. will update. call stands.

I will trade at 30%.

The overseas call has the bias. will update. call stands.

Wednesday, August 11, 2010

Thursday's Call.

The call is 40% long emerging markets and 60% long spx.

I will trade at 30%.

the overseas call has the bias. I was unable to post by close so this is for the record.

I am not feeling confident of an up day tomorrow.

I will trade at 30%.

the overseas call has the bias. I was unable to post by close so this is for the record.

I am not feeling confident of an up day tomorrow.

Tuesday, August 10, 2010

Wednesday's call.

the call is 40% long Emerging markets and 60% long spx.

I will trade at 80%.

The overseas call has the bias. will update. the call is now short spx .100% trade.

I will trade at 80%.

The overseas call has the bias. will update. the call is now short spx .100% trade.

Monday, August 9, 2010

Tuesday's Call.

The call is 40% long emerging markets and 60% long spx.

I will trade at 70%.

the overseas call has the bias.

I will trade at 70%.

the overseas call has the bias.

Friday, August 6, 2010

Monday's 8-9-10 call.

The call is 60% short emerging markets and 40% long spx.

I will trade at 90%.

The overseas call has the bias.

I will trade at 90%.

The overseas call has the bias.

Thursday, August 5, 2010

Friday's call.

the call is 60% short Japan and 40% short spx.

I will trade at 60%.

The overseas call has the bias. will update.

I will trade at 60%.

The overseas call has the bias. will update.

Wednesday, August 4, 2010

Thursday's Call.

the call is 40% long Japan and 60% long spx.

I will trade at 80%.

The domestic call has the bias. will update. call stands.

I will trade at 80%.

The domestic call has the bias. will update. call stands.

Tuesday, August 3, 2010

Wednesday's call.

The call is 40% long emerging markets and 60% long spx.

I will trade at 70%.

the domestic call has the bias. I will update. call stands.

I will trade at 70%.

the domestic call has the bias. I will update. call stands.

Monday, August 2, 2010

Tuesday's Call.

The call is 40% long emerging markets and 60% long spx.

I will trade at 50%.

the domestic call has the bias. If the market moves much I will update.

I will trade at 50%.

the domestic call has the bias. If the market moves much I will update.

Friday, July 30, 2010

Monday's 8-2-10 call.

the call is 60% short eem and 40% long spx.

I will trade at 80%.

The overseas call has the bias. will update. The call has changed to 60% long eem and 60% trade.

I will trade at 80%.

The overseas call has the bias. will update. The call has changed to 60% long eem and 60% trade.

Thursday, July 29, 2010

Friday's call.

the call is 60% short china and 40% long spx.

I will trade at 80%.

the overseas call has the bias. will update.call stands.

I will trade at 80%.

the overseas call has the bias. will update.call stands.

Wednesday, July 28, 2010

Thursday's Call.

the call is 60% long japan and 40% long spx.

I will trade at 70%.

The overseas call has the bias. will update. call stands.

I will trade at 70%.

The overseas call has the bias. will update. call stands.

Tuesday, July 27, 2010

Wednesday's call.

The call is 60% long china and 40% short spx.

I will trade at 80%.

The overseas call has the bias. Will update if market moves much from here. call stands.

I will trade at 80%.

The overseas call has the bias. Will update if market moves much from here. call stands.

Monday, July 26, 2010

Tuesday's Call.

The call is 60% short china and 40% short spx.

I will trade at 60%.

the overseas call has the bias. will update call has changed to long spx. will trade at 90%.

I will trade at 60%.

the overseas call has the bias. will update call has changed to long spx. will trade at 90%.

Friday, July 23, 2010

Monday's 7-26-10 call.

the call is 40% long China and 60% short spx.

I will trade at 80%.

The overseas call has the bias. Will update. Call stands

I will trade at 80%.

The overseas call has the bias. Will update. Call stands

Thursday, July 22, 2010

Friday's call.

the call is 70% long China and 30% short spx.

I will trade at 70%.

the EM call has the bias.

I may on occasion specify which overseas market to follow. Generally the EEM or a leveraged etf or mutual fund tracking the EEM will work with the system for the overseas position.

I will trade at 70%.

the EM call has the bias.

I may on occasion specify which overseas market to follow. Generally the EEM or a leveraged etf or mutual fund tracking the EEM will work with the system for the overseas position.

Wednesday, July 21, 2010

Thursday's Call.

the call is 75% short Emerging Markets and 25% short spx.

I will trade at 60%.

the EM call has the bias. Will update. Call stands.

I will trade at 60%.

the EM call has the bias. Will update. Call stands.

Tuesday, July 20, 2010

Wednesday's call.

The call is 25% short Emerging Markets and 75% short spx.

I will trade at 70%.

The EM system has the bias. Will update. call stands

I will trade at 70%.

The EM system has the bias. Will update. call stands

Monday, July 19, 2010

Tuesday's Call.

The call is 25% long Emerging Markets and 75% long spx.

I will trade at 40%.

The EM call has the bias.

the call stands

I will trade at 40%.

The EM call has the bias.

the call stands

Friday, July 16, 2010

Monday's 7-19-10 call.

The call is 25% long Emerging Markets and 75% short spx.

I will trade at 80%.

The EM call has the bias.

I will trade at 80%.

The EM call has the bias.

Friday's call.

the call is 25% long Emerging markets and 75% long spx.

I will trade at 30%.

the Domestic call has the bias. For the record.

I will trade at 30%.

the Domestic call has the bias. For the record.

Wednesday, July 14, 2010

Thursday's Call.

the call is 25% short Emerging markets and 75 % long spx.

I will trade at 50%.

the domestic call has the bias.

I will trade at 50%.

the domestic call has the bias.

Tuesday, July 13, 2010

Wednesday's call.

The call is 75% short Emerging Markets and 25% long spx.

I will trade at 60%.

the domestic system has the bias.

I will trade at 60%.

the domestic system has the bias.

Monday, July 12, 2010

Tuesday's Call.

the call is 75% short Emerging Markets and 25% long spx.

I will trade at 80%.

the domestic system has the bias.

I will trade at 80%.

the domestic system has the bias.

Saturday, July 10, 2010

Monday's 7-12-10 call.

the call is 75% short Emerging Markets and 25% long spx.

I will trade at 70%.

the domestic system has the bias.

I will trade at 70%.

the domestic system has the bias.

Friday, July 9, 2010

Friday's call.

the call is 75% short Emerging Markets and 25% long spx.

I will trade at 70%.

The EM system has the bias.

This is for the record.

I will trade at 70%.

The EM system has the bias.

This is for the record.

Thursday, July 8, 2010

Thursday's Call.

The call is 75% short Emerging markets and 25% long spx.

I will trade at 70%.

The EM system has the bias.

I am traveling for a couple of weeks so posting may be erratic.....This call is for the record to track the system.

I will trade at 70%.

The EM system has the bias.

I am traveling for a couple of weeks so posting may be erratic.....This call is for the record to track the system.

Tuesday, July 6, 2010

Wednesday's call.

the call is 25% long Emerging Markets and 75% long spx.

I will trade at 40%.

The EM system has the bias.

Will update. I guess my update did not post.. It was that the call stands.

I will trade at 40%.

The EM system has the bias.

Will update. I guess my update did not post.. It was that the call stands.

Friday, July 2, 2010

Tuesday's Call.

The call is 75% short Emerging Markets and 25% short spx.

I will trade at 40%.

The EM system has the bias.

Will update. Short spx has changed to long. and 25% EM and 75% spx.

I will trade at 40%.

The EM system has the bias.

Will update. Short spx has changed to long. and 25% EM and 75% spx.

Thursday, July 1, 2010

Friday's call.

the call is 25% short Emerging markets and 75% short spx.

I will trade at 60%.

The em system has the bias.

Will update. call stands.

I will trade at 60%.

The em system has the bias.

Will update. call stands.

Wednesday, June 30, 2010

Thursday's Call.

the call is 25% long Emerging markets and 75% long spx.

I will trade at 20%.

the EM system has the bias.

Not confident that the market will rebound much tomorrow.

Will update. call stands.

I will trade at 20%.

the EM system has the bias.

Not confident that the market will rebound much tomorrow.

Will update. call stands.

Tuesday, June 29, 2010

Wednesday's call.

The call is 75% long Emerging markets and 25% long spx.

I will trade at 30%.

The EM call has the bias.

After today's drop I hesitate to be fully long for tomorrow. That is the reason for 30%.

Unless the market rebounds from here this call should stand.

I will trade at 30%.

The EM call has the bias.

After today's drop I hesitate to be fully long for tomorrow. That is the reason for 30%.

Unless the market rebounds from here this call should stand.

Monday, June 28, 2010

Tuesday's Call.

the call is 75% short Emerging markets and 25% short spx.

I will trade at 50%.

The EM system has the bias.

Will update. Call stands.

I will trade at 50%.

The EM system has the bias.

Will update. Call stands.

Friday, June 25, 2010

Monday's 6-28-10 call.

the call is 75% long Emerging markets and 25% short spx.

I will trade at 80%.

The EM system has the bias.

Will update. the call stands.

I will trade at 80%.

The EM system has the bias.

Will update. the call stands.

Thursday, June 24, 2010

Friday's call.

The call is 75% short Emerging markets and 25% long spx.

I will trade at 70%.

the EM call has the bias. will update.

The call stands.

I will trade at 70%.

the EM call has the bias. will update.

The call stands.

Wednesday, June 23, 2010

Thursday's Call.

The call is 75% short Emerging markets and 25% long spx.

I will trade at 80%.

the EM system has the bias.

I will update.

the call stands.

I will trade at 80%.

the EM system has the bias.

I will update.

the call stands.

Tuesday, June 22, 2010

Wednesday's call.

the call is 25% short emerging markets and 75% short spx.

I will trade at 60%.

The EM system has the bias.

Will update.

Call stands.

I will trade at 60%.

The EM system has the bias.

Will update.

Call stands.

Monday, June 21, 2010

Tuesday's Call.

the call is 75% long Emerging markets and 25% short spx.

I will trade at 70%.

The Domestic call has the bias.

will update. the call is 25% short EM and 75% long spx.

I will trade at 70%.

The Domestic call has the bias.

will update. the call is 25% short EM and 75% long spx.

Friday, June 18, 2010

Monday's 6-21-10 call.

The call is 25% short Emerging markets and 75% long spx.

I will trade at 80%.

The domestic call has the bias.

I will update.

The call stands.

I will trade at 80%.

The domestic call has the bias.

I will update.

The call stands.

Thursday, June 17, 2010

Friday's call.

The call is 25% long Emerging markets and 75% long spx.

I will trade at 60%.

The domestic call has the bias.

Will update if market moves much from 3:10 prices.

Call stands.

I will trade at 60%.

The domestic call has the bias.

Will update if market moves much from 3:10 prices.

Call stands.

Wednesday, June 16, 2010

Thursday's Call.

The call is 25% short Emerging markets and 75% short rut.

I will trade at 70%.

The domestic call has the bias.

Will update.

The allocation has switched to 75/25dom.

I will trade at 70%.

The domestic call has the bias.

Will update.

The allocation has switched to 75/25dom.

Returns for week ending 6-11-10.

No good news last week...law of averages would say the system should turn around and have some positive weeks. We shall see.

Tuesday, June 15, 2010

Wednesday's call.

The call is 75% short Emerging markets and 25% short ndx.

I will trade at 60%.

The domestic call has the bias.

Unless the market falls from here I will not update.

I will trade at 60%.

The domestic call has the bias.

Unless the market falls from here I will not update.

Monday, June 14, 2010

Tuesday's Call.

The call is 25% short Emerging markets and 75% long ndx.

I will trade at 40%.

The domestic call has the bias.

Will update.

.

The call stands

I will trade at 40%.

The domestic call has the bias.

Will update.

.

The call stands

Friday, June 11, 2010

Monday's 6-14-10 call.

The call is 75% short Emerging markets and 25% short spx.

I will trade at 50%.

The emerging system has the bias.

I will update.

It has switched to 25% short EM and 75% short spx.

I will trade at 50%.

The emerging system has the bias.

I will update.

It has switched to 25% short EM and 75% short spx.

Thursday, June 10, 2010

Friday's call.

the call is 75% short Emerging markets and 25% short Rut.

I will trade at 60%.

the domestic call has the bias.

I will trade at 60%.

the domestic call has the bias.

Returns for week ending 6-04-10.

The system is not handling this current market move very well at all. This current week will also be a loss. Personally will be trading at somewhat reduced exposure and see if the system recovers at all.

Wednesday, June 9, 2010

Thursday's Call.

the call is 25% short Emerging Markets and 75% long spx.

I will trade at 50%.

The Domestic call has the bias.

I will update neare close.

Domestic call has switched short . I will trade at 70%

I will trade at 50%.

The Domestic call has the bias.

I will update neare close.

Domestic call has switched short . I will trade at 70%

Tuesday, June 8, 2010

Wednesday's call.

the call is 25% long Emerging markets and 75% long spx.

I will trade at 60%

The domestic call has the bias.

I will update. the call stands

I will trade at 60%

The domestic call has the bias.

I will update. the call stands

Monday, June 7, 2010

Tuesday's Call.

The call is 25% long Emerging markets and 75% short rut.

I will trade at 70%.

The Domestic call has the bias.

If the market doesn't hold these levels then we could drop to the 1010-1020 level on the SP500 which would be 38% retracement of the run up from March 09.

the domestic call will switch long.

I will trade at 70%.

The Domestic call has the bias.

If the market doesn't hold these levels then we could drop to the 1010-1020 level on the SP500 which would be 38% retracement of the run up from March 09.

the domestic call will switch long.

Friday, June 4, 2010

Monday's 6-7-10 call.

The call is 25% long Emerging markets and 75% long Rut.

I will trade at 60%.

The Domestic call has the bias.

May not be good to be long after today, tho we typically get a rebound.

I will trade at 60%.

The Domestic call has the bias.

May not be good to be long after today, tho we typically get a rebound.

Thursday, June 3, 2010

Friday's call.

The call is 25% long Emerging Markets and 75% long Rut.

I will trade at 60%.

The Domestic call has the bias.

Will update. The call stands.

I will trade at 60%.

The Domestic call has the bias.

Will update. The call stands.

Wednesday, June 2, 2010

Thursday's Call.

The call is 25% short emerging Markets and 75% short rut.

I will trade at 80%.

The Domestic call has the bias.

I will update nearer close.

the call stands.

I will trade at 80%.

The Domestic call has the bias.

I will update nearer close.

the call stands.

Tuesday, June 1, 2010

Wednesday's call.

The call is 75% long Emerging Markets and 25% short rut.

I will trade at 60%.

The Domestic call has the bias.

Will update nearer close. has changed to 25% long EM and 75% short rut.

will confirm nearer close the call has switched to 25% short EM and 75% long rut.

I will trade at 60%.

The Domestic call has the bias.

Will update nearer close. has changed to 25% long EM and 75% short rut.

will confirm nearer close the call has switched to 25% short EM and 75% long rut.

Friday, May 28, 2010

Tuesday's Call.

the call is 75% long Emerging Markets and 25% short Rut.

I will trade at 70%.

The Domestic call has the bias.

Will update nearer close.

call stands

I will trade at 70%.

The Domestic call has the bias.

Will update nearer close.

call stands

Thursday, May 27, 2010

Friday's call.

The call is 75% long Emerging markets and 25% short dji.

I will trade at 70%.

The domestic call has the bias.

Ouch that is a large day to be on the wrong side. Actually my system was right but it had a programing error that revealed itself this morning. Not sure if that makes me feel any better.

Will update. The call stands.

I will trade at 70%.

The domestic call has the bias.

Ouch that is a large day to be on the wrong side. Actually my system was right but it had a programing error that revealed itself this morning. Not sure if that makes me feel any better.

Will update. The call stands.

Wednesday, May 26, 2010

Thursday's Call.

the call is 25% Short Emerging Markets and 75% short Rut.

I will trade at 80%.

The EM call has the bias.

Will update.

the call stands.

I will trade at 80%.

The EM call has the bias.

Will update.

the call stands.

Tuesday, May 25, 2010

Wednesday's call.

the call is 25% long Emerging markets and 75% long spx.

I will trade at 60%.

The EM call has the bias.

Will update.

At this time the EM call has switched short. will confirm in a couple of minutes.

Short EM and long Domestic markets is the call.

I will trade at 60%.

The EM call has the bias.

Will update.

At this time the EM call has switched short. will confirm in a couple of minutes.

Short EM and long Domestic markets is the call.

Monday, May 24, 2010

Tuesday's Call

The call is 25% long Emerging Markets and 75% long rut.

I will trade at 70%.

The Domestic call has the bias.

I will update nearer close tho this call should hold.

the call stands.

I will trade at 70%.

The Domestic call has the bias.

I will update nearer close tho this call should hold.

the call stands.

Returns for week ending 5-21-10.

Not making any profits at this rate. Lets hope the market corrects a little more, then we might have room to run up again. I suspect the markets will be more news driven than in the run up from March-09. So things need to stabilize on the European scene and not domino around the world. Good luck to all traders.

Friday, May 21, 2010

Monday's Call 5-24-10.

The call will be 25% long Emerging Markets and 75% short rut.

I will trade at 70%.

The Domestic call has the bias.

I will update as this may change.

the EM call has switched short.

I will trade at 70%.

The Domestic call has the bias.

I will update as this may change.

the EM call has switched short.

Thursday, May 20, 2010

Friday's call.

The call is 25% long Emerging Markets and 75% short Rut.

I will trade at 70%.

The Domestic call has the bias.

Should not need to update unless the market climbs a lot from here.

I can not see how tomorrow will be an up day, being Friday.

I will trade at 70%.

The Domestic call has the bias.

Should not need to update unless the market climbs a lot from here.

I can not see how tomorrow will be an up day, being Friday.

Wednesday, May 19, 2010

Thursday's Call.

The call is 75% long Emerging Markets and 25% long Rut.

I will trade at 70%.

The domestic call has the bias.

Not too profitable being long in this market.

The rut call will switch short if the dji closes above 10458.4

I will trade at 70%.

The domestic call has the bias.

Not too profitable being long in this market.

The rut call will switch short if the dji closes above 10458.4

Tuesday, May 18, 2010

Wednesday's Call.

the call is 75% long Emerging Markets and 25% long rut.

I will trade at 80%.

The Domestic call has the bias.

I will update.

the call stands.

I will trade at 80%.

The Domestic call has the bias.

I will update.

the call stands.

Monday, May 17, 2010

Tuesday's Call.

The call is 75% long Emerging Markets and 25% long rut.

I will trade at 70%.

the EM system has the bias.

I will update near close.

the rut call has switched short.

I will trade at 70%.

the EM system has the bias.

I will update near close.

the rut call has switched short.

Returns for week ending 5-14-10

Higher volatility can be good for market timers if their calls are correct. I would expect continued high volatility this coming week. I would hope the system can be in the black for two consecutive weeks.

Friday, May 14, 2010

Monday's Call 5-17-10 .

the call is 75% long Emerging Markets and 25% long dji.

I will trade at 30%.

The Em system has the bias.

I will trade at 30%.

The Em system has the bias.

Thursday, May 13, 2010

Friday's call.

the call is 75% long Emerging markets and 25% long spx.

I will trade at 40%.

The EM system has the bias.

Will update near close.

the spx call switched to short...I will trade at 60%

I will trade at 40%.

The EM system has the bias.

Will update near close.

the spx call switched to short...I will trade at 60%

Wednesday, May 12, 2010

Thursday's Call.

The call is 75% short Emerging Markets and 25% short ndx.

I will trade at 50%.

The domestic call has the bias.

I will trade at 50%.

The domestic call has the bias.

Tuesday, May 11, 2010

Wednesday's Call

The call is 70% long Emerging Markets and 30% long dji.

I will trade at 70%.

The Domestic call has the bias.

I will update as the Domestic call will change if the market continues to fall.

the call stands.

I will trade at 70%.

The Domestic call has the bias.

I will update as the Domestic call will change if the market continues to fall.

the call stands.

Monday, May 10, 2010

Tuesday's Call.

The call is 70% short Emerging markets and 30% short rut.

I will trade at 60%.

The EM call has the bias.

I will trade at 60%.

The EM call has the bias.

Returns for week ending 5-07-10

Not a good week with all the volatility.....this week showed that a human input into a mechanical system, i.e., adjusting the allocation may help moderate swings in returns. Tho generally on up weeks it lessens returns somewhat. Likewise the new system has moderated drawdowns. Now if we could have a series of up weeks!

Friday, May 7, 2010

Monday's Call 5-10-10

The call is 30% short Emerging markets and 70% long ndx.

I will trade at 60%

The EM call has the bias.

Will update.

the call stands.

I will trade at 60%

The EM call has the bias.

Will update.

the call stands.

Thursday, May 6, 2010

Friday's call.

the call is 30% long Emerging markets and 70% long ndx.

I will trade at 40% and reduce domestic to 2x for reporting purposes.

The EM call has the bias.

Market getting exciting now! Hoping this will be a correction of lesser degree for the economy's sake. I have been long the dollar for the last two days as a hedge. Not sure if I would follow my system and be very long tomorrow. But it could rebound, who knows?

I will trade at 40% and reduce domestic to 2x for reporting purposes.

The EM call has the bias.

Market getting exciting now! Hoping this will be a correction of lesser degree for the economy's sake. I have been long the dollar for the last two days as a hedge. Not sure if I would follow my system and be very long tomorrow. But it could rebound, who knows?

Wednesday, May 5, 2010

Thursday's Call.

The call is 30% long Emerging Markets and 70% long rut.

I will trade at 60%.

The Emerging call has the bias

Will update.

The call stands.

I will trade at 60%.

The Emerging call has the bias

Will update.

The call stands.

Tuesday, May 4, 2010

Wednesday's Call

The call is 30% long EM and 70% long Rut.

I will trade at 40%.

The Emerging Market system has the bias.

I will trade at 40%.

The Emerging Market system has the bias.

Monday, May 3, 2010

Tuesday's Call.

The call is 70% short Emerging Markets and 30% short rut.

I will trade at 70%.

The domestic call has the bias.

I will update.

the Domestic call switches long.

I will trade at 70%.

The domestic call has the bias.

I will update.

the Domestic call switches long.

Returns for week ending 4-30-10

Not getting ahead at this rate, tho today helps. More volatility coming back to the market....now is when the calls need to be correct. If volatility increases I may report Domestic returns as if traded with 2x leverage and/or reduce exposure. It was a bad week for Domestic Market system, but the new system helped ease the pain.

Friday, April 30, 2010

Monday's Call 5-03-10

the call is 70% long EM and 30% long Rut.

I will trade at 70%.

The Domestic system has the bias.

I will trade at 70%.

The Domestic system has the bias.

Thursday, April 29, 2010

Friday's call.

The call is 70% short EM and 30% long Rut.

I will trade at 80%.

The domestic call has the bias.

I will trade at 80%.

The domestic call has the bias.

Wednesday, April 28, 2010

Thursday's Call.

the call is 30% short EM and 70% short rut.

I will trade at 70%

the domestic call has the bias.

The em has switched to long.

I will trade at 70%

the domestic call has the bias.

The em has switched to long.

Tuesday, April 27, 2010

Wednesday's Call

The call is 30% Long EM and 70% short rut.

I will trade at 80%.

The Domestic call has the bias.

Will update near close.

It changes to 70% EM and 30% domestic. I will trade at 50%.

I will trade at 80%.

The Domestic call has the bias.

Will update near close.

It changes to 70% EM and 30% domestic. I will trade at 50%.

Monday, April 26, 2010

Tuesday's Call.

The call is 30% long EM and 70% short ndx.

I will trade at 90%

the Domestic call has the bias.

If the Rut closes below 738.21 The Domestic call will switch.

IF the adre closes below 44.93. The EM call will switch.

I will trade at 90%

the Domestic call has the bias.

If the Rut closes below 738.21 The Domestic call will switch.

IF the adre closes below 44.93. The EM call will switch.

Friday, April 23, 2010

Monday's Call 4-26-10

The call is 30% long EM and 70% long spx.

I will trade at 80%.

The Domestic call has the bias.

If the adre closes below 44.75 the EM call will switch.

I will trade at 80%.

The Domestic call has the bias.

If the adre closes below 44.75 the EM call will switch.

Thursday, April 22, 2010

Friday's call.

The call is 30% long EM and 70% long ndx.

I will trade at 70%.

The domestic call has the bias.

If the eem closes above 42.67 the EM call will switch and I will trade at 100%.

The call has changed to 70% em and 30% dom.

Ended at 70% short EM and 30% long ndx.

I will trade at 70%.

The domestic call has the bias.

If the eem closes above 42.67 the EM call will switch and I will trade at 100%.

The call has changed to 70% em and 30% dom.

Ended at 70% short EM and 30% long ndx.

Wednesday, April 21, 2010

Thursday's Call.

the call is 30% short EM and 70% long rut.

I will trade at 100%

the domestic call has the bias.

I will trade at 100%

the domestic call has the bias.

Tuesday, April 20, 2010

Wednesday's Call

The call is 30% short EM and 70% long spx.

I will trade at 100%

The Domestic call has the bias.

I will trade at 100%

The Domestic call has the bias.

Returns for week ending 4-16-10

Not a good week! Still need to improve returns of domestic portion. I did not tally the two days I was not able to post or trade. I personally stayed all short...which helped Friday. I will try to go to cash if I am not able to trade in the future.

Monday, April 19, 2010

Tuesday's Call.

the call is 30% long EM and 70% long ndx.

I will trade at 70%.

The domestic system has the bias.

Will update if change.

I will trade at 70%.

The domestic system has the bias.

Will update if change.

Friday, April 16, 2010

Monday's Call 4-19-10

the call is 30% long EM and 70% long Rut.

i will trade at 70%.

Domestic system has the bias.

Am working on a call.

Have been out of touch with the internet....canoeing.

i will trade at 70%.

Domestic system has the bias.

Am working on a call.

Have been out of touch with the internet....canoeing.

Tuesday, April 13, 2010

Wednesday's Call

The call is 30% short EM and 70% short rut.

I will trade at 80%.

The Domestic call has the bias.

I will update if market moves much from here.

calls stand.

I will trade at 80%.

The Domestic call has the bias.

I will update if market moves much from here.

calls stand.

Monday, April 12, 2010

Tuesday's Call.

The call is 70% short EM and 30% long ndx.

I will trade 100%.

The domestic call has the bias.

I will trade 100%.

The domestic call has the bias.

Friday, April 9, 2010

Monday's Call 4-12-10

The call will be 70% long EM and 30% long ndx.

I will trade at 90%.

The domestic call has the bias.

This will stand unless the market makes a large move between now and close.

I will trade at 90%.

The domestic call has the bias.

This will stand unless the market makes a large move between now and close.

Thursday, April 8, 2010

Friday's call.

the call is 70% short EM and 30% short rut.

I will trade at 90%.

The EM call has the bias.

I will update nearer close.

the call stands.

I will trade at 90%.

The EM call has the bias.

I will update nearer close.

the call stands.

Wednesday, April 7, 2010

Thursday's Call.

the call is 70% long EM and 30% long rut.

I will trade at 80%

The domestic call has the bias.

I will trade at 80%

The domestic call has the bias.

Tuesday, April 6, 2010

Wednesday's Call

The call is 70% short EM and 30% short rut.

I will trade at 80%.

the rut call has the bias.

If the maket moves up much more will update near close.

I will trade at 80%.

the rut call has the bias.

If the maket moves up much more will update near close.

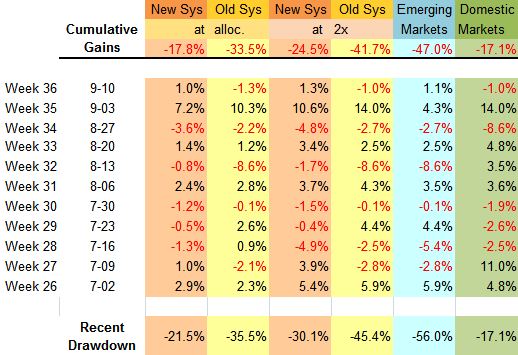

System Returns for duration of blog

Here is a chart of the System's returns in comparison to the spx since first posting on this blog. This is at full allocation. As you can see it has large swings.

Monday, April 5, 2010

Tuesday's Call.

The call is 70% long EM and 30% long ndx.

I will trade at 70%.

The EM system has the bias.

If the market moves much will update near close.

I will trade at 70%.

The EM system has the bias.

If the market moves much will update near close.

Returns for week ending 4-02-10

The week was a wash...tho the new system kept it's head above water compared to the others. the domestic markets subsystem needs some help....I will be looking into that, tho taxes will take most of my time this week. The markets took a breather and consolidated last week .....wonder if they will make some new highs this week?

Thursday, April 1, 2010

Monday's Call 4-05-10

The call is 70% short EM and 30% long spx.

I will trade at 90%.

the EM sys has the bias.

I will trade at 90%.

the EM sys has the bias.

Wednesday, March 31, 2010

Thursday's Call.

The call is 70% long EM and 30% long spx. <>

I will trade at 40%.

the EM sys has the bias.

If the adre closes below 43.97 the EM call will switch and I will trade at 90%.

The call has changed to short the Rut. the EM call will depend on the 3:50 price.

The call ended up being short EM and Short Rut. The adre closed above 43.97 but the 3:50 price was 43.94. The futures look like it will be an up day for EM but this could change before close.

I will trade at 40%.

the EM sys has the bias.

If the adre closes below 43.97 the EM call will switch and I will trade at 90%.

The call has changed to short the Rut. the EM call will depend on the 3:50 price.

The call ended up being short EM and Short Rut. The adre closed above 43.97 but the 3:50 price was 43.94. The futures look like it will be an up day for EM but this could change before close.

Tuesday, March 30, 2010

Wednesday's Call

the call is 30% long EM and 70% long rut.

I will trade at 60%.

The EM sys has the bias.

I will trade at 60%.

The EM sys has the bias.

Monday, March 29, 2010

Tuesday's Call.

The call is 70% long EM and 30% long rut.

I will trade at 90%.

The EM call has the bias.

I will trade at 90%.

The EM call has the bias.

Friday, March 26, 2010

Monday's Call 3-27-10

The call is 70% long EM and 30% long spx.

I will trade at 90%.

The domestic sys has the bias.

I will trade at 90%.

The domestic sys has the bias.

Thursday, March 25, 2010

Friday's call.

The call is 30% short em and 70% short rut.

I will trade at 100%.

the domestic has the bias

I will trade at 100%.

the domestic has the bias

Wednesday, March 24, 2010

Thursday's Call.

the call is 30% short EM and 70% long Rut.

I will trade at 100%.

The domestic call has the bias.

If the rut closes above 686.5 the call will switch.

I will trade at 100%.

The domestic call has the bias.

If the rut closes above 686.5 the call will switch.

Tuesday, March 23, 2010

Wednesday's Call

The call is 30% long the EM and 70% long the rut.

I will trade at 80%.

The EM call will switch if the eem closes below 41.36.

The domestic call has the bias.

I will trade at 80%.

The EM call will switch if the eem closes below 41.36.

The domestic call has the bias.

Monday, March 22, 2010

Tuesday's Call.

The call is 30% short EM and 70% long spx.

I will trade at 100%.

The EM system has the bias.

If the eem closes below 41.21 the EM call will switch.

I will trade at 100%.

The EM system has the bias.

If the eem closes below 41.21 the EM call will switch.

Returns for week ending 3-19-10

Another week in the black....Nothing too exciting, Let's see if it can continue, the emerging markets system has had a comeback of 55% since its low in late January....of course it had a large drawdown then so it is obviously volatile. Of the blended systems the new one is holding its own so far. Hopefully this will continue to be the case.

Friday, March 19, 2010

Monday's Call 3-22-10

The call is 30% long EM and 70% long spx.

I will trade at 90%.

The EM system has the bias.

I will trade at 90%.

The EM system has the bias.

Thursday, March 18, 2010

Friday's call.

The call is 70% short EM and 30% long spx.

I will trade 100%.

The EM sys has the bias.

I will trade 100%.

The EM sys has the bias.

Wednesday, March 17, 2010

Thursday's Call.

the call is 30% long EM and 70% long spx.

I will trade at 70%.

The EM system has the bias.

I will trade at 70%.

The EM system has the bias.

Tuesday, March 16, 2010

Wednesday's Call

The call is 30% short EM and 70% short ndx. <>

I will trade at 70%.

The em sys has the bias.

Will update.

The Domestic call has switched to long spx.

I will trade at 90%.

I will trade at 70%.

The em sys has the bias.

Will update.

The Domestic call has switched to long spx.

I will trade at 90%.

Monday, March 15, 2010

Tuesday's Call.

The call is 30% long EM and 70% long spx. <>

I will trade at 80%.

The EM system has the bias.

Will update nearer close.

The domestic call has switched to short ndx.

I will trade at 80%.

The EM system has the bias.

Will update nearer close.

The domestic call has switched to short ndx.

Returns for week ending 3-12-10

Not staying fully invested when the systems are hot does not return as well.....However if we have a losing streak we should gain some back as in week 3 and 4. Just happy to be on the positive side for a while.

Friday, March 12, 2010

Monday's Call 3-15-10

the call is 30% short EM and 70% long ndx.

I will trade at 100%.

The ndx call has the bias.

If the eem closes below 41.16 that call will switch.

Will update near close... system is in flux........The call stands!

I will trade at 100%.

The ndx call has the bias.

If the eem closes below 41.16 that call will switch.

Will update near close... system is in flux........The call stands!

Thursday, March 11, 2010

Friday's call.

The call is 30% long EM and 70% long ndx.

I will trade at 100%.

The EM system has the bias.

Will update near close.

The call is now long ndx.

I will trade at 100%.

The EM system has the bias.

Will update near close.

The call is now long ndx.

Wednesday, March 10, 2010

Thursday's Call.

The call is 30% long EM and 70% long ndx.

I will trade at 60%.

The EM call has the bias.

I will trade at 60%.

The EM call has the bias.

Tuesday, March 9, 2010

Wednesday's Call

the call is 30% long EM and 70% long ndx.

I will trade at 80%.

The EM system still has the bias.

I will trade at 80%.

The EM system still has the bias.

Monday, March 8, 2010

Tuesday's Call.

The call is 30% long EM and 70% long dji.

I will trade at 75% of capital.

the EM system has the bias.

If the eem closes below 40.97 the call will switch.

I will trade at 75% of capital.

the EM system has the bias.

If the eem closes below 40.97 the call will switch.

Returns for week ending 3-05-10

The market it steadily gaining back it's recent losses. This may continue thru April or longer if the job market can turn around.

Friday, March 5, 2010

Monday's Call 3-08-10

the call for Monday is 30% short EM and 70% short dji.

I will trade at 50% portfolio.

The EM sys has the bias.( Old sys)

I will trade at 50% portfolio.

The EM sys has the bias.( Old sys)

Thursday, March 4, 2010

Friday's call.

the call is 70% short EM and 30% long spx. <>

I will trade at 1.75x.

the EM call has the bias.

If the market moves much from here I will update.

The call switched to Long EM and short dji. as per post.

I will trade at 1.75x.

the EM call has the bias.

If the market moves much from here I will update.

The call switched to Long EM and short dji. as per post.

Wednesday, March 3, 2010

Thursday's Call.

The call is 70% long EM and 30% long spx.

I will trade at 1.5x.

The EM call has the bias.

Will update near close.

The call stands as is.

I will trade at 1.5x.

The EM call has the bias.

Will update near close.

The call stands as is.

Tuesday, March 2, 2010

Wednesday's Call

The call is 30% long EM and 70% long spx.

I will trade at 1.5x.

the EM call has the bias.

Will update near close.

The calls stand.

I will trade at 1.5x.

the EM call has the bias.

Will update near close.

The calls stand.

Monday, March 1, 2010

Tuesday's Call.

The call is 30% short EM and 70% long spx.

I will trade at 1.25x.

The EM has the bias.

I will trade at 1.25x.

The EM has the bias.

Friday, February 26, 2010

Monday's Call 3-01-10

The call is 70% long EM and 30% short spx.

I will trade at 2x.

the EM has the bias.

if the eem closes below 38.82 then that call will switch......if the spx closes below 1103.49 then the respective call will switch.

I will update near close.

Both calls stand.

I will trade at 2x.

the EM has the bias.

if the eem closes below 38.82 then that call will switch......if the spx closes below 1103.49 then the respective call will switch.

I will update near close.

Both calls stand.

Thursday, February 25, 2010

Friday's call.

The call is 30% long EM and 70% short dji.

I will trade at 1.75x

The Emerging Markets call has the bias.

the domestic call could change.....I will update nearer close.

The call changed to long spx as of 3:50.

I will trade at 1.75x

The Emerging Markets call has the bias.

the domestic call could change.....I will update nearer close.

The call changed to long spx as of 3:50.

Wednesday, February 24, 2010

Thursday's Call.

The call is 70% short EM and 30% long spx.

I will trade at 1.75x.

the Emerging Markets have the bias.

If the eem closes below 38.77 the call switches.

I will trade at 1.75x.

the Emerging Markets have the bias.

If the eem closes below 38.77 the call switches.

Tuesday, February 23, 2010

Wednesday's Call

The call is 70% short EM and 30% long spx.

I will trade at 1.75x.

The Emerging Markets have the bias.

I will trade at 1.75x.

The Emerging Markets have the bias.

Monday, February 22, 2010

Returns for week ending 2-19-10

February is much better than January for the trading system. The new system is hanging in there. Hope to see this continue.

Tuesday's Call.

The call is 30% short EM and 70% long spx.

I will trade at 1.75x.

The Emerging Market call has the bias.

I will trade at 1.75x.

The Emerging Market call has the bias.

Friday, February 19, 2010

Monday's Call 2-22-10

The call is 30% long EM and 70% long spx.

I will trade at 1.75x.

the Emerging Markets have the bias.

the spx call will switch short if the spx closes below 1096.24.

How do you like todays call? Short EM....long Domestic.

I will trade at 1.75x.

the Emerging Markets have the bias.

the spx call will switch short if the spx closes below 1096.24.

How do you like todays call? Short EM....long Domestic.

Thursday, February 18, 2010

Friday's call.

The call is 30% short EM and 70% long spx.

I will trade at 1.25x.

The Emerging Markets have the bias.

If the eem closes above 39.83 the EM call will switch long.

the price of the eem at 3:50 was 39.83 so the call is short EM.

I will trade at 1.25x.

The Emerging Markets have the bias.

If the eem closes above 39.83 the EM call will switch long.

the price of the eem at 3:50 was 39.83 so the call is short EM.

Wednesday, February 17, 2010

Thursday's Call.

The call is 30% long EM and 70% long spx.

I will trade at 1.5x.

The EM system has the bias.

The EM call will switch short if the eem closes above 39.69

I will trade at 1.5x.

The EM system has the bias.

The EM call will switch short if the eem closes above 39.69

Tuesday, February 16, 2010

Wednesday's Call

The call is 30% long EM and 70% long spx.

I will trade at 1.5x

The EM call has the bias.

If the spx closes below 1089.71 the spx call will switch.

I will trade at 1.5x

The EM call has the bias.

If the spx closes below 1089.71 the spx call will switch.

Friday, February 12, 2010

Tuesday,s Call 2-16-10

The call is 30% long EM and 70% long spx.

I will trade 1.75x.

the EM call has the bias.

The spx call will switch if the spx closes below 1068.22.

I will trade 1.75x.

the EM call has the bias.

The spx call will switch if the spx closes below 1068.22.

Thursday, February 11, 2010

Friday's call.

the call is 30% long EM and 70% long dji.

I will trade at 1.5x.

The Emerging Market call has the bias.

I will trade at 1.5x.

The Emerging Market call has the bias.

Wednesday, February 10, 2010

Thursday's Call.

The call is 30% long EM and 70% long spx.

I will trade at 1.25x.

The bias is for the Emerging Markets call.

I will trade at 1.25x.

The bias is for the Emerging Markets call.

Tuesday, February 9, 2010

Wednesday's Call

the call is 30% short EM and 70% long spx.

I will trade at 1.5x.

If the spx closes below 1067.3 then the spx call will switch.

The spx has the bias.

I am changing the domestic call to short as of 3:44 PM

I will trade at 1.5x.

If the spx closes below 1067.3 then the spx call will switch.

The spx has the bias.

I am changing the domestic call to short as of 3:44 PM

Monday, February 8, 2010

Tuesday's Call.

the call is 30% long EM and 70% short SPX.

I will trade at 1.75x.

the spx call has the bias.

I will trade at 1.75x.

the spx call has the bias.

Friday, February 5, 2010

Monday's Call 2-8-10

the call is 30% short EM and 70% short spx.

I will trade at 1.25x.

The spx call will switch if the spx closes below 1048.76.

The spx call has the bias.

I will trade at 1.25x.

The spx call will switch if the spx closes below 1048.76.

The spx call has the bias.

Thursday, February 4, 2010

Fridays call.

the call is 40% long EM and 60% long spx.

I will trade at 1x.

The spx has the bias.

Not sure how much of tomorrow's economic reports are factored in today's move. So will scale back as we could continue down.

I will trade at 1x.

The spx has the bias.

Not sure how much of tomorrow's economic reports are factored in today's move. So will scale back as we could continue down.

Wednesday, February 3, 2010

Thursday's Call.

the call is 60% short EM and 40% long spx.

I will trade at 1.75x.

The EM call will switch if the eem closes above 39.65.

The spx call has the bias.

I will trade at 1.75x.

The EM call will switch if the eem closes above 39.65.

The spx call has the bias.

Tuesday, February 2, 2010

Wednesday's Call

The call is 60% long EM and 40% long spx.

I will trade at 1.5x.

The spx call has the bias.

I will trade at 1.5x.

The spx call has the bias.

Monday, February 1, 2010

Tuesday's Call.

The call is 40% short EM and 60% long ndx.

I will trade at 1.5x.

if the eem closes below 39.09 the call will switch.

The ndx has the bias.

I will trade at 1.5x.

if the eem closes below 39.09 the call will switch.

The ndx has the bias.

Friday, January 29, 2010

Monday's Call 2-1-10

The call is 60% short EM and 40% long ndx.

I will trade at 1.5x.

If the eem closes above 38.29 the call is long.

The bias is ndx.

The EM call was long at 3:50 and short at close. According to sys rules it will be long.

I will trade at 1.5x.

If the eem closes above 38.29 the call is long.

The bias is ndx.

The EM call was long at 3:50 and short at close. According to sys rules it will be long.

Thursday, January 28, 2010

Fridays call.

The call is 60% long EM and 40% short ndx.

I will trade at1.5x.

if the eem closes between 38.56 and 38.99 the EM call stands .....if the ndx closes above 1792.53 the call switches.

The ndx call has the bias.

I will trade at1.5x.

if the eem closes between 38.56 and 38.99 the EM call stands .....if the ndx closes above 1792.53 the call switches.

The ndx call has the bias.

Wednesday, January 27, 2010

Thursday's Call.

The call is 40% long EM and 60% long the ndx.

I will trade at 1.75x.

If the ndx closes below 1804.76 Then the call switches to short ndx.

The ndx call has the bias.

I will trade at 1.75x.

If the ndx closes below 1804.76 Then the call switches to short ndx.

The ndx call has the bias.

Tuesday, January 26, 2010

Wednesday's Call

the call is 60% long emerging markets and 40% short ndx.

I will trade at 1.75x

If the eem closes above 39.56 then that call will switch. if the ndx closes below 1803.29 then it's call will switch.

The ndx call is the bias (old system)

I will trade at 1.75x

If the eem closes above 39.56 then that call will switch. if the ndx closes below 1803.29 then it's call will switch.

The ndx call is the bias (old system)

Monday, January 25, 2010

Returns for week ending 1-22.

So far this year it would have been better to stay with the old system. Let's see if this continues. I am thinking of using 3x ETFs to trade for the Domestic markets portion of the new system....This will balance better with the emerging side as it is generally more volatile. I will record the returns of the Domestic portion as if it tracks a corresponding 3x etf long or short.

Tuesday's Call.

The call is 60% long emerging markets and 40% short the ndx.

I will trade at 1.75x.

The bias is short ndx.

the emerging markets call will flip to short if the eem closes below 39.95.

Ended up short emerging markets with the eem closing below 39.95.

I will trade at 1.75x.

The bias is short ndx.

the emerging markets call will flip to short if the eem closes below 39.95.

Ended up short emerging markets with the eem closing below 39.95.

Friday, January 22, 2010

Monday's Call 1-25

the call is 60% long eem and 40% short ndx.

I will trade at 2x.

The bias is short ndx.

I will trade at 2x.

The bias is short ndx.

Thursday, January 21, 2010

Fridays call.

The call is 40% long emerging markets and 60% long Rut.

I will trade at 1.5x.

As per your request Jim, the bias is long Rut.

I will trade at 1.5x.

As per your request Jim, the bias is long Rut.

Wednesday, January 20, 2010

Tuesday, January 19, 2010

Wednesday's Call

The call is 60% long emerging markets and 40% short rut .

I will trade at 2x.

If the rut closes below 645.93 then its call will switch to long.

I will trade at 2x.

If the rut closes below 645.93 then its call will switch to long.

Friday, January 15, 2010

Tuesday's Call.

the call is 40% short emerging markets and 60% short dji.

if the eem closes above 41.99 then the emerging call will switch long.

I will trade at 1.75x.

if the eem closes above 41.99 then the emerging call will switch long.

I will trade at 1.75x.

Thursday, January 14, 2010

Fridays call.

The call is 60% long emerging markets and 40% long Rut.

If the adre closes above 44.66 then the emerging call will be short side.

I will trade at 2x.

If the adre closes above 44.66 then the emerging call will be short side.

I will trade at 2x.

Wednesday, January 13, 2010

Returns for week ending 1-08.

Here are the returns for the first week of the new year. I will most likely trade at 2x for a period. I will track the new system and old system for comparison. Also will post emerging and domestic subsystems for comparison.....Likely the Emerging market system will out perform the rest but also have larger drawdowns. Of course my intention is that the new system will be the most stable and not trail any of the others by too much.

Thursday's Call.

The call is 60% long emerging markets and 40% short rut.

The dji must close above 10634.5 or the call will change to long Domestic.

I will trade at 2x.

The dji must close above 10634.5 or the call will change to long Domestic.

I will trade at 2x.

Tuesday, January 12, 2010

Monday, January 11, 2010

Tuesday's Call.

the signal is short 40% emerging markets and long 60% DJI.

I will trade at 2x.

emerging market call may change...note comment.

I will trade at 2x.

emerging market call may change...note comment.

Friday, January 8, 2010

Thursday, January 7, 2010

Fridays call.

the call is long 40% emerging markets....short 60% ndx.

I will trade at 2x.

The call stands.

I am thinking of being all in at 2x for a period but allocated between domestic markets and emerging markets. This should mellow swings in returns. I have not been successful in switching between the two, so will see how this works out.

I will trade at 2x.

The call stands.

I am thinking of being all in at 2x for a period but allocated between domestic markets and emerging markets. This should mellow swings in returns. I have not been successful in switching between the two, so will see how this works out.

Wednesday, January 6, 2010

Thursday's Call.

The call is to be long tomorrow.

I will trade 70% emerging markets and 30% NDX.

I am going to try allocating a percentage of trading capital to both emerging markets and Domestic markets. Some days I may be short one and long another. It will be more difficult to trade but hopefully help returns.

I will trade 70% emerging markets and 30% NDX.

I am going to try allocating a percentage of trading capital to both emerging markets and Domestic markets. Some days I may be short one and long another. It will be more difficult to trade but hopefully help returns.

Tuesday, January 5, 2010

Monday, January 4, 2010

Tuesday's Call.

The call is to be on the short side for tomorrow.

I will trade emerging markets at 1.5x.

I will trade emerging markets at 1.5x.

Returns for week ending 12-31.

Well, Did not end the year with a bang. I am not particularly happy with recent performance of the system. I may try some refinements to help bolster returns. After last years volatile markets I tried to keep the system's returns from fluctuating strongly. There is a fine line between toning down the system and reducing returns.

I think I will start our accounting of returns fresh as of the new year, even tho I have not posted a full 52 weeks since starting this blog. Let's see if the system can keep ahead of the markets and hope the powers that be do not meddle too much with over regulation. Good luck too all!

Subscribe to:

Posts (Atom)