The call is 10% long Emerging Markets and 90% short spx.

I will trade at 80%. Will update. call stands.

I will now be following Australia with EWA. I will most likely trade Funds that track Emerging Markets in my accounts that do not have an Australian Fund when the system follows EWA.

Showing posts with label Forecaster Trading System Discussion. Show all posts

Showing posts with label Forecaster Trading System Discussion. Show all posts

Wednesday, June 29, 2011

Friday, May 20, 2011

Monday's 5-23-11 call.

The call is 10% long china and 90% long dji.

I will trade at 60%. Will update.Call stands.

I am going to juggle around some of the indexes I am tracking.....will track BKTEM instead of EEM as that is what Profunds tracks for Emerging Markets.

I will trade at 60%. Will update.Call stands.

I am going to juggle around some of the indexes I am tracking.....will track BKTEM instead of EEM as that is what Profunds tracks for Emerging Markets.

Tuesday, November 2, 2010

Returns for week ending 10-29-10.

New system is performing well so will personally follow its calls. I am also posting a futures trading system on Collective2, which will hopefully generate some cash outside my IRA. It is named E-Mini Maxi.

Monday, November 1, 2010

Tuesday's Call.

The call is 65% long eem and 35% short spx.

I will trade at 80%. Will update. call stands.

Am posting both calls again as returns have been better using both calls.

I will trade at 80%. Will update. call stands.

Am posting both calls again as returns have been better using both calls.

Wednesday, October 13, 2010

Returns for week ending 10-08-10.

The "new system" has out performed the domestic calls which I decided to follow the last two weeks. It is par for the course that when the grass appears greener on the other side and you jump then it will whipsaw. I will continue to post one call for a period as I work to improve aspects of the new system.

Monday, September 20, 2010

Tuesday's Call.

The call is 70% short spx.

Due to lackluster performance of new system., I will be trading one system for a period.

Due to lackluster performance of new system., I will be trading one system for a period.

Thursday, July 22, 2010

Friday's call.

the call is 70% long China and 30% short spx.

I will trade at 70%.

the EM call has the bias.

I may on occasion specify which overseas market to follow. Generally the EEM or a leveraged etf or mutual fund tracking the EEM will work with the system for the overseas position.

I will trade at 70%.

the EM call has the bias.

I may on occasion specify which overseas market to follow. Generally the EEM or a leveraged etf or mutual fund tracking the EEM will work with the system for the overseas position.

Thursday, May 6, 2010

Friday's call.

the call is 30% long Emerging markets and 70% long ndx.

I will trade at 40% and reduce domestic to 2x for reporting purposes.

The EM call has the bias.

Market getting exciting now! Hoping this will be a correction of lesser degree for the economy's sake. I have been long the dollar for the last two days as a hedge. Not sure if I would follow my system and be very long tomorrow. But it could rebound, who knows?

I will trade at 40% and reduce domestic to 2x for reporting purposes.

The EM call has the bias.

Market getting exciting now! Hoping this will be a correction of lesser degree for the economy's sake. I have been long the dollar for the last two days as a hedge. Not sure if I would follow my system and be very long tomorrow. But it could rebound, who knows?

Thursday, April 8, 2010

Friday's call.

the call is 70% short EM and 30% short rut.

I will trade at 90%.

The EM call has the bias.

I will update nearer close.

the call stands.

I will trade at 90%.

The EM call has the bias.

I will update nearer close.

the call stands.

Tuesday, April 6, 2010

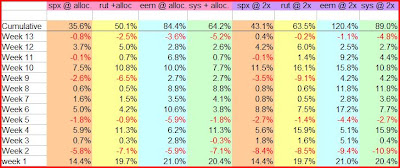

System Returns for duration of blog

Here is a chart of the System's returns in comparison to the spx since first posting on this blog. This is at full allocation. As you can see it has large swings.

Monday, January 25, 2010

Returns for week ending 1-22.

So far this year it would have been better to stay with the old system. Let's see if this continues. I am thinking of using 3x ETFs to trade for the Domestic markets portion of the new system....This will balance better with the emerging side as it is generally more volatile. I will record the returns of the Domestic portion as if it tracks a corresponding 3x etf long or short.

Wednesday, January 13, 2010

Returns for week ending 1-08.

Here are the returns for the first week of the new year. I will most likely trade at 2x for a period. I will track the new system and old system for comparison. Also will post emerging and domestic subsystems for comparison.....Likely the Emerging market system will out perform the rest but also have larger drawdowns. Of course my intention is that the new system will be the most stable and not trail any of the others by too much.

Thursday, January 7, 2010

Fridays call.

the call is long 40% emerging markets....short 60% ndx.

I will trade at 2x.

The call stands.

I am thinking of being all in at 2x for a period but allocated between domestic markets and emerging markets. This should mellow swings in returns. I have not been successful in switching between the two, so will see how this works out.

I will trade at 2x.

The call stands.

I am thinking of being all in at 2x for a period but allocated between domestic markets and emerging markets. This should mellow swings in returns. I have not been successful in switching between the two, so will see how this works out.

Wednesday, January 6, 2010

Thursday's Call.

The call is to be long tomorrow.

I will trade 70% emerging markets and 30% NDX.

I am going to try allocating a percentage of trading capital to both emerging markets and Domestic markets. Some days I may be short one and long another. It will be more difficult to trade but hopefully help returns.

I will trade 70% emerging markets and 30% NDX.

I am going to try allocating a percentage of trading capital to both emerging markets and Domestic markets. Some days I may be short one and long another. It will be more difficult to trade but hopefully help returns.

Tuesday, January 5, 2010

Monday, January 4, 2010

Tuesday's Call.

The call is to be on the short side for tomorrow.

I will trade emerging markets at 1.5x.

I will trade emerging markets at 1.5x.

Monday, October 5, 2009

Returns for week ending 10-02.

Finally had a good week. It was a little hard to follow as the closing prices ended near system switch points, leading me to initiate a new rule (to use the 3:50ET price as the price to judge long or short) if the system depends on that day's closing price for the call. This should make the system much easier to use and not significantly change the returns as only a relatively few days will make the call different than the close. One caveat to that statement is, if strong volatility comes back to the market then I will have to reconsider.

Thursday, October 1, 2009

Friday's call.

The call is to switch long if the eem closes below 37.94.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

Thursday, July 2, 2009

June Totals

The total return for June using the system's suggested allocations was spx 10.8%....rut 12.5%....and the eem 15.8%.

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

Monday, June 29, 2009

Returns for week ending 6-26.

After a good day Monday I considered going to cash for the rest of the week. In hindsight that would have been right.

It would appear looking at my chart of returns, that following the eem or the systems calls at full allocation would have been the best overall, however if the system were to have some consecutive negative weeks I would expect the more conservative spx or sys @ allocation to gain ground. I may try to allocate more if the system continues to perform well.

Subscribe to:

Posts (Atom)