The signal is to switch short unless the spx closes below 1115.72.

I will trade spx at 2x.

Happy and Prosperous New Year to everyone!

Thursday, December 31, 2009

Wednesday, December 30, 2009

Tuesday, December 29, 2009

Monday, December 28, 2009

Thursday, December 24, 2009

Monday's Call 12-28

The call is to stay long.

Was out last minute shopping and did not make it back in time to post.

Was out last minute shopping and did not make it back in time to post.

Wednesday, December 23, 2009

Thursday's Call.

The call is to switch long.

I will trade spx at 1.75x.

Everyone have a Merry Christmas!!

I will trade spx at 1.75x.

Everyone have a Merry Christmas!!

Tuesday, December 22, 2009

Wednesday's Call

The call is to stay short at this point.

I will trade spx at 1.75x. Will update near close.

The call remains short.

I will trade spx at 1.75x. Will update near close.

The call remains short.

Monday, December 21, 2009

Tuesday's Call.

The plan is to switch short for tomorrow unless the spx closes below 1110.19.

I will trade spx at 1.25x.

I will trade spx at 1.25x.

Friday, December 18, 2009

Thursday, December 17, 2009

Fridays call.

the call is to stay long.

I will trade spx at 1.75x.

The call has switched to short at 3:50.

I will trade spx at 1.75x.

The call has switched to short at 3:50.

Wednesday, December 16, 2009

Thursday's Call.

The call is to stay short if the ndx closes below 1799.11.

Will trade spx at 1.75x.

Ended up on the long side.

Will trade spx at 1.75x.

Ended up on the long side.

Tuesday, December 15, 2009

Monday, December 14, 2009

Tuesday's call

the call is to stay short unless the spx closes below 1112.78.

I will trade spx at 1.5x. Will update at 3:50 if call changes.

Staying short.

I will trade spx at 1.5x. Will update at 3:50 if call changes.

Staying short.

Friday, December 11, 2009

Monday's call 12-14-09

The call is to stay short.

I will trade rut at 1.5x.

It hasn't been a good call to be short on Monday,s. Will update near close.

I will trade rut at 1.5x.

It hasn't been a good call to be short on Monday,s. Will update near close.

Thursday, December 10, 2009

Friday's call.

the call is to stay short at this point.

I will trade rut at 1.75x.

will update near close.

It stays short.

I will trade rut at 1.75x.

will update near close.

It stays short.

Wednesday, December 9, 2009

Thursday's Call.

The system's call is to stay short unless the spx closes below 1087.17.

I will trade spx at 1.75x.

I will trade spx at 1.75x.

Tuesday, December 8, 2009

Wednesday's call

The call is to stay short if the spx closes between 1088.4 and 1092.8.

I will trade spx at 1.5x.

I will trade spx at 1.5x.

Monday, December 7, 2009

Tuesday's call

The call is to stay short if the rut closes below 603.2..

I will trade the spx at 1.25x.

The call could change nearer close so I will update then.

The call is to stay short.

I will trade the spx at 1.25x.

The call could change nearer close so I will update then.

The call is to stay short.

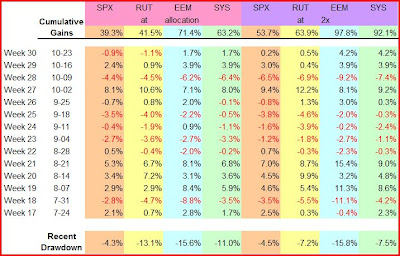

Returns for week ending 12-04.

Friday, December 4, 2009

Monday's call 12-07-09

The call is to switch short for Monday unless the spx closes over 1111.7.

I will trade spx at 1.75x.

I will trade spx at 1.75x.

Thursday, December 3, 2009

Friday's call.

The call is to stay long unless the spx closes above 1111.50..

I will trade spx at 1.25x.

THe call is now to go short if the dji closes below 10364.

I will trade spx at 1.25x.

THe call is now to go short if the dji closes below 10364.

Wednesday, December 2, 2009

Thursday's Call.

The system says to stay short.

I will trade the rut at 1.75x.

call may change if market moves much...I will repost nearer close.

If the spx closes at 3:50 above 1109.8 then the call is to go long.

I will trade the rut at 1.75x.

call may change if market moves much...I will repost nearer close.

If the spx closes at 3:50 above 1109.8 then the call is to go long.

Tuesday, December 1, 2009

Monday, November 30, 2009

Tuesday's call

THe call is to stay short if the dji closes above 10258..

I will trade the dji at 1.5x.

I will trade the dji at 1.5x.

Returns for week ending 11-27.

Friday, November 27, 2009

Wednesday, November 25, 2009

Friday's call.

The call is to switch short if the dji closes between 10345 and 10512.

there may be a qualifying condition to check...if the eem closes below 41.43 reverse the above call.

I will trade the dji at 1.75x.

Everyone have a great Thanksgiving!

there may be a qualifying condition to check...if the eem closes below 41.43 reverse the above call.

I will trade the dji at 1.75x.

Everyone have a great Thanksgiving!

Returns for week ending 11-20.

Tuesday, November 24, 2009

Wednesday's call

the call is to stay short.

I will trade dji at 1.25x.

Will check call nearer close.

The call WILL CHANGE TO LONG.

I will trade dji at 1.25x.

Will check call nearer close.

The call WILL CHANGE TO LONG.

Monday, November 23, 2009

Tuesday's call

the call is to stay short if the dji closes above 10395.55.

I will trade the dji at 1.25x.

If the market falls much more between now and close I may update the call.

The call will stand.

I will trade the dji at 1.25x.

If the market falls much more between now and close I may update the call.

The call will stand.

Friday, November 20, 2009

Monday's call 11-23-09

the call is to switch long.

I will trade the emerging markets at 1.75x.

However the call today may change nearer close...I will update later.

The call has changed to short and I will trade dji..

I will trade the emerging markets at 1.75x.

However the call today may change nearer close...I will update later.

The call has changed to short and I will trade dji..

Thursday, November 19, 2009

Wednesday, November 18, 2009

Thursday's Call.

The system believes the market will rise tomorrow if the eem closes between 41.16 and 41.95.

I will trade the eem at 1.5x.

I will trade the eem at 1.5x.

Tuesday, November 17, 2009

Wednesday's call

The call is to switch long if the eem closes above 41.71.

I will trade emerging markets at 1.25x.

I will trade emerging markets at 1.25x.

Monday, November 16, 2009

Tuesday's call

The call is to switch short if the eem does not close between 40.65 and 41.88.

I will trade the emerging markets at 1.25x

I will trade the emerging markets at 1.25x

Friday, November 13, 2009

Monday's call 11-16-09

The call is to stay long if the eem closes above 40.50.

I will trade emerging markets at 1.5x.

I will trade emerging markets at 1.5x.

Thursday, November 12, 2009

Friday's call.

The call is to stay short unless the eem closes below 40.45

I will trade emerging markets at 1.25x.

I will trade emerging markets at 1.25x.

Wednesday, November 11, 2009

Thursday's Call.

The call for tomorrow is to switch short if the adre closes above 44.25.

I will trade emerging markets at 1.5x.

I will trade emerging markets at 1.5x.

Tuesday, November 10, 2009

Returns for week ending 11-6.

Monday, November 9, 2009

Friday, November 6, 2009

Monday's call 11-09-09

The call is to switch short if the eem closes below 39.65.

I will trade the spx at 1.75

I will trade the spx at 1.75

Thursday, November 5, 2009

Friday's call.

The call is to stay short if the eem closes between 38.65 and 39.56.

I will trade spx at 1.75x

will go long

I will trade spx at 1.75x

will go long

Wednesday, November 4, 2009

Thursday's Call.

The call is to switch short if the eem closes between 38.67 and 39.60 where it is now.

I will trade spx at 1.5x.

I will trade spx at 1.5x.

Tuesday, November 3, 2009

Monday, November 2, 2009

Tuesday's call

the call is to switch long if the spx closes between 1026.35 and 1049.42.

I will trade the spx at 1.75x.

I will trade the spx at 1.75x.

Returns for week ending 10-30.

This week started out great but was canceled out somewhat by the last two days calls. During the week the system made new highs in some subsystems. This past week, following the Allocation calls rather than being 2x all week, saved some of the early week gains.

Also the system following the rut payed off better than other subsystems. It is nice to see that the systems rules/criteria helped make some gains this week.

Friday, October 30, 2009

Monday's call 11-02-09

The call is to switch short.

I will trade the spx at 1.75x.

Volatility returning to the market place...it may be prudent to reduce exposure.

I will trade the spx at 1.75x.

Volatility returning to the market place...it may be prudent to reduce exposure.

Thursday, October 29, 2009

Friday's call.

The call is to switch long if the rut closes above 573.44.....however if the eem closes above 39.51 then the call will be reversed.

I will trade the rut at 1.25x.

Ended up long but at reduced exposure...could be an up day as it is the end of the month.

I will trade the rut at 1.25x.

Ended up long but at reduced exposure...could be an up day as it is the end of the month.

Wednesday, October 28, 2009

Tuesday, October 27, 2009

Wednesday's call

The call is to switch long if the rut closes between 590.71 and 594.08.....the qualifier is to go opposite the call if the eem closes between 40.07 and 40.99.

I will trade the rut at 1.75x.

Staying short.

I will trade the rut at 1.75x.

Staying short.

Monday, October 26, 2009

Tuesday's call

The call is to switch long unless the spx closes above 1072.26.....however the call will have a qualifier to go opposite the call if the eem closes between 40.12 and 41.04.

I will trade rut at 2x.

I will trade rut at 2x.

Friday, October 23, 2009

Monday's call 10-26-09

the call is to stay long if the rut closes below 604.49. However there is a qualifying condition that should be checked....If the eem closes between 40.08 and 41.00 then the call's direction will be switched.

I will trade the rut at 2x.

Am posting early as I need to do some errands.

Looks like we will be short for Monday.

I will trade the rut at 2x.

Am posting early as I need to do some errands.

Looks like we will be short for Monday.

Thursday, October 22, 2009

Friday's call.

The call is to switch long unless the eem closes below 40.90.

I will trade emerging markets at 2x.

I will trade emerging markets at 2x.

Wednesday, October 21, 2009

Tuesday, October 20, 2009

Wednesday's call

The call is to stay short unless the adre closes above 44.58.

I will trade the emerging markets at 1.75x

I am posting early as I may not have access to internet later today.

I will trade the emerging markets at 1.75x

I am posting early as I may not have access to internet later today.

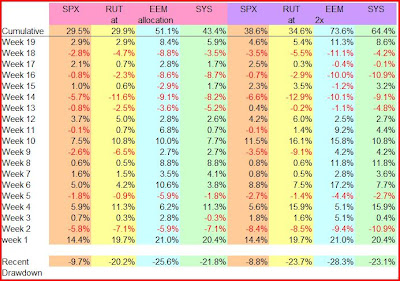

Returns for week ending 10-16.

Monday, October 19, 2009

Tuesday's call

the call is to switch short if the adre closes above 44.18.

I will trade the emerging markets at 1.5x.

I will trade the emerging markets at 1.5x.

Friday, October 16, 2009

Thursday, October 15, 2009

Friday's call.

The call is to stay long if the adre closes above 43.79.

I will trade emerging markets at 0.5x

I will trade emerging markets at 0.5x

Wednesday, October 14, 2009

Tuesday, October 13, 2009

Wednesday's call

the call is to say long if the adre closes above 42.57

I will trade the emerging markets at 1.25x

I will trade the emerging markets at 1.25x

Monday, October 12, 2009

Tuesday's call

The call is to switch short if the adre closes between 42.09 and 42.47.

I will trade emerging markets at 1.75x.

I will trade emerging markets at 1.75x.

Friday, October 9, 2009

Monday's call 10-12-09

the call is to switch short if the adre closes between 42.28 and 42.36.

I will trade emerging markets at 1.5x.

this week did not go as I would have hoped...pretty much lost what we gained last week.

Everyone enjoy your weekend and hopefully some have Monday off!

Ended up long for Monday.

I will trade emerging markets at 1.5x.

this week did not go as I would have hoped...pretty much lost what we gained last week.

Everyone enjoy your weekend and hopefully some have Monday off!

Ended up long for Monday.

Thursday, October 8, 2009

Wednesday, October 7, 2009

Thursday's Call.

the call is to stay short unless the eem closes below 38.94.

I will trade the emerging markets at 1.75x.

I will trade the emerging markets at 1.75x.

Tuesday, October 6, 2009

Monday, October 5, 2009

Returns for week ending 10-02.

Finally had a good week. It was a little hard to follow as the closing prices ended near system switch points, leading me to initiate a new rule (to use the 3:50ET price as the price to judge long or short) if the system depends on that day's closing price for the call. This should make the system much easier to use and not significantly change the returns as only a relatively few days will make the call different than the close. One caveat to that statement is, if strong volatility comes back to the market then I will have to reconsider.

Friday, October 2, 2009

Monday's call 10-05-09

The call is to stay short if the eem closes between 37.53 and 38.63.

I will trade the eem at 1.0x with the 3:50ET price.

I will trade the eem at 1.0x with the 3:50ET price.

Thursday, October 1, 2009

Friday's call.

The call is to switch long if the eem closes below 37.94.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

Wednesday, September 30, 2009

Thursday's Call.

the call is to be short if the eem closes above 38.92.

I will trade emerging markets at 1.75x.

I ended up on the short side as it went to 38.91 seconds before close. I don't like these days where the market picks my trigger point to gyrate around. I may look into picking a price before the close...say 3:50.

I will trade emerging markets at 1.75x.

I ended up on the short side as it went to 38.91 seconds before close. I don't like these days where the market picks my trigger point to gyrate around. I may look into picking a price before the close...say 3:50.

Tuesday, September 29, 2009

Wednesday's call

the call is to switch short if the eem closes above 38.69.

I will trade emerging markets at 1.25x.

Technically the signal ended long for tomorrow, but since the eem was flipping both sides of the signal near close I will count tomorrow as a wash for tracking the systems returns.

I will trade emerging markets at 1.25x.

Technically the signal ended long for tomorrow, but since the eem was flipping both sides of the signal near close I will count tomorrow as a wash for tracking the systems returns.

Monday, September 28, 2009

Tuesday's call

the call is to stay long if the eem closes below 38.65.

I will trade the emerging markets at 1.5x.

Stayed long tho if you can't enter your position near or after close, it would have been a guess.

I will trade the emerging markets at 1.5x.

Stayed long tho if you can't enter your position near or after close, it would have been a guess.

Friday, September 25, 2009

Monday's call 9-28-09

the call is to stay long if the eem closes between 37.70 and 38.18.

I will trade spx at 1.75x.

ended up on the long side.

I will trade spx at 1.75x.

ended up on the long side.

Thursday, September 24, 2009

Friday's call.

the call is to switch long if the eem closes below 38.28.

I will trade the spx at 1.5x.

I will trade the spx at 1.5x.

Wednesday, September 23, 2009

Thursday's Call.

the call is to stay long unless the eem closes below 39.30.

I will trade emerging markets at 1.5x.

The call ended up being short.

I will trade emerging markets at 1.5x.

The call ended up being short.

Tuesday, September 22, 2009

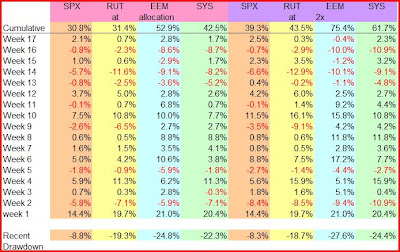

Returns for week ending 9-18.

Wednesday's call

the call is to stay long unless the spx closes above 1078.

I will trade spx at 1.5x.

I am changing the call to long emerging markets at 1.75x.

I will trade spx at 1.5x.

I am changing the call to long emerging markets at 1.75x.

Monday, September 21, 2009

Friday, September 18, 2009

Thursday, September 17, 2009

Wednesday, September 16, 2009

Tuesday, September 15, 2009

Monday, September 14, 2009

Tuesday's call

The call is to switch long if the eem closes below 37.88.

I will trade emerging markets at 2.0x.

I will trade emerging markets at 2.0x.

Friday, September 11, 2009

Thursday, September 10, 2009

Friday's call.

the call is to switch long if the adre closes below 40.16.

I will trade the emerging markets at 1.75x.

Ended up short for tomorrow, hope that works as I'm glad I was only half in today.

I will trade the emerging markets at 1.75x.

Ended up short for tomorrow, hope that works as I'm glad I was only half in today.

Wednesday, September 9, 2009

Thursday's Call.

The call is to be long if the adre closes between 39.24 and 39.60.

I will trade emerging markets at 1.0x.

Ended up on the short side.

I will trade emerging markets at 1.0x.

Ended up on the short side.

Tuesday, September 8, 2009

Wednesday's call

The forecast is to stay long if the adre closes between 39.22 and 39.53.

I will trade the emerging markets at 1.5x.

At this moment the adre is indicating to be short tomorrow, but that may change before closing.

I will trade the emerging markets at 1.5x.

At this moment the adre is indicating to be short tomorrow, but that may change before closing.

Returns for week ending 9-04.

Friday, September 4, 2009

Thursday, September 3, 2009

Friday's call.

The call is to switch short as long as the eem closes above 34.71

I will trade the spx at 1.5x.

I will trade the spx at 1.5x.

Wednesday, September 2, 2009

Tuesday, September 1, 2009

Monday, August 31, 2009

Returns for week ending 8-28.

Friday, August 28, 2009

Thursday, August 27, 2009

Friday's call.

The call is to stay long unless the eem closes above 36.29.

I will trade spx at 1.75x.

I will trade spx at 1.75x.

Wednesday, August 26, 2009

Thursday's Call.

The call is to switch long if the eem closes below 36.41.

I will trade the emerging markets at 1.75x.

I will trade the emerging markets at 1.75x.

Tuesday, August 25, 2009

Wednesdays call

The call is to switch short if the eem closes between 36.29 and 36.49.

I will trade emerging markets at 1.5x.

Ended up being on the short side for Wednesday.

I will trade emerging markets at 1.5x.

Ended up being on the short side for Wednesday.

Monday, August 24, 2009

Tuesday's call

The call is to switch long if the eem closes above 36.33.

Will trade the emerging markets at 2x.

I believe I will change my exposure to 1.25x as quite a few sources are looking at a pullback.

Will trade the emerging markets at 2x.

I believe I will change my exposure to 1.25x as quite a few sources are looking at a pullback.

Friday, August 21, 2009

Thursday, August 20, 2009

Friday's call.

the call is to stay short if the rut closes between 562.03 and 566.26.

I will trade the rut at 2x.

Ended up long.

I will trade the rut at 2x.

Ended up long.

Wednesday, August 19, 2009

Thursday's Call.

I will stay short if the rut closes between 551.81 and 563.10.

I will trade the rut at 2.0x

I will trade the rut at 2.0x

Tuesday, August 18, 2009

Wednesday's call

The call is to switch short unless the rut closes below 553.11.

I will trade the rut at 1.5x.

I will trade the rut at 1.5x.

Monday, August 17, 2009

Returns for week ending 8-14.

Friday, August 14, 2009

Monday's call 8-17-09

The call is to switch long unless the ndx closes above 1606.

I will trade the ndx at 1.25x.

Stayed short.

I will trade the ndx at 1.25x.

Stayed short.

Thursday, August 13, 2009

Wednesday, August 12, 2009

Thursday's Call.

The call is to switch short if the ndx closes in the green.

I will trade the ndx at 1.0x

I will trade the ndx at 1.0x

Tuesday, August 11, 2009

Monday, August 10, 2009

Tuesday's call

The system is calling to be short tomorrow.

Edit: Will be short unless the spx closes positive.

I will trade the spx at 1.5x.

Edit: Will be short unless the spx closes positive.

I will trade the spx at 1.5x.

Friday, August 7, 2009

Thursday, August 6, 2009

Friday's call.

The call is to stay long unless the dji closes below 9225.28.

I will trade the spx at 1x.

I will trade the spx at 1x.

Wednesday, August 5, 2009

Thursday's Call.

The call is to be short if the eem closes between 36.50 and 36.80.

I will trade at 1.25x the emerging markets.

Ended up long.

I will trade at 1.25x the emerging markets.

Ended up long.

Tuesday, August 4, 2009

Wednesday's call

The call is to switch long if the dji closes negative.

Will trade the spx at 1.5x

Ended up short.

Will trade the spx at 1.5x

Ended up short.

Monday, August 3, 2009

Returns for week ending 7-31.

Friday, July 31, 2009

Thursday, July 30, 2009

Friday's call.

The call is to stay short. Not that it is working too well today.

Will trade spx at 1.25x.

Well I was obviously wrong about buyers waiting for more pullback. However that was just an opinion to support the systems position. The system is mechanical, and I follow it's calls....if I feel strongly that it may be wrong I only reduce the calls exposure. Hoping for some profit taking tomorrow.

Will trade spx at 1.25x.

Well I was obviously wrong about buyers waiting for more pullback. However that was just an opinion to support the systems position. The system is mechanical, and I follow it's calls....if I feel strongly that it may be wrong I only reduce the calls exposure. Hoping for some profit taking tomorrow.

Wednesday, July 29, 2009

Thursday's Call.

The call is to be short for tomorrow unless the dji closes above 9037.6 or the spx closes below 966.4.

Edit: I will go short unless the rut closes below 547.4.

I am positioned short for tomorrow. This market still has people looking for pullbacks on which to enter. But I think we should get some more downside before too many buy again.

Will trade at 1.75x the spx.

Edit: I will go short unless the rut closes below 547.4.

I am positioned short for tomorrow. This market still has people looking for pullbacks on which to enter. But I think we should get some more downside before too many buy again.

Will trade at 1.75x the spx.

Tuesday, July 28, 2009

Wednesday's call

the call is to switch long unless the spx closes below 975.5.

I will trade the spx at 1.5x.

I will trade the spx at 1.5x.

Monday, July 27, 2009

Tuesday's call

the call is to stay short unless the ndx closes below 1591.06.

will trade the ndx at 1.75x.

will trade the ndx at 1.75x.

Friday, July 24, 2009

Monday's call 7-27-09

The call is to stay short if the ndx closes below 1609.53.

Will trade the ndx at 1.5x.

Will trade the ndx at 1.5x.

Thursday, July 23, 2009

Wednesday, July 22, 2009

Thursday's Call.

The call is to switch long if the ndx closes above 1560.78.

I will trade the ndx at 1x.

I will trade the ndx at 1x.

Tuesday, July 21, 2009

Wednesday's call

The call is to stay long unless the spx closes positive.

Will trade the ndx at 1.5x.

ended up short side for Wednesday.

Will trade the ndx at 1.5x.

ended up short side for Wednesday.

Returns for week ending 7-17.

Monday, July 20, 2009

Tuesday's call

Will be long for tomorrow unless the ndx closes below 1534.90.

will trade the ndx at 1.25x.

will trade the ndx at 1.25x.

Friday, July 17, 2009

Monday's call 7-20-09

the call is to switch short if the ndx closes in positive territory.

Will trade the ndx at 0.3x.

Will trade the ndx at 0.3x.

Thursday, July 16, 2009

Wednesday, July 15, 2009

Thursday's Call.

Ouch! Not fun to be wrong on a big day.

Will switch to long side at 0.3x and trade the eem.

Will switch to long side at 0.3x and trade the eem.

Tuesday, July 14, 2009

Wednesday's call

Will stay short unless the eem closes below 31.09.

will trade emerging markets 1.5x.

will trade emerging markets 1.5x.

Monday, July 13, 2009

Returns for week ending 7-10.

Tuesday's call

The call will be to switch short unless the eem closes below 30.66.

I will trade the eem at 1.5x.

I will trade the eem at 1.5x.

Friday, July 10, 2009

Thursday, July 9, 2009

Friday's call.

the call is to be long tomorrow.

Will trade the emerging markets at 0.3x.

Edit: if the dji closes negative will go short the eem at 1.5x.

Since the Dow Jones was flipping positive negative at close, I personally ended up going short but will not count it toward system's gains or losses.

Will trade the emerging markets at 0.3x.

Edit: if the dji closes negative will go short the eem at 1.5x.

Since the Dow Jones was flipping positive negative at close, I personally ended up going short but will not count it toward system's gains or losses.

Wednesday, July 8, 2009

Thursday's Call.

The call is to stay long unless the rut closes above 478.25.

Will trade the rut at 1.75x.

May end up short for tomorrow unless we fall back some.

Short it is.

Will trade the rut at 1.75x.

May end up short for tomorrow unless we fall back some.

Short it is.

Tuesday, July 7, 2009

Monday, July 6, 2009

Tuesday's call

If the dji and spx finish positive the call is to be 1x short.

IF the dji is positive and spx negative at close the call is long at 0.3x.

If both close negative then the call is 0.3x short.

How's that for confusing?

Will trade the spx.

Ended up short for tomorrow.

IF the dji is positive and spx negative at close the call is long at 0.3x.

If both close negative then the call is 0.3x short.

How's that for confusing?

Will trade the spx.

Ended up short for tomorrow.

Returns for week ending 7-03.

Returns for last week were not of the sort that I would like to see. I guess one can't expect to be right all the time, but after two negative weeks I definitely would like the coming week to have some gains. I will most likely trade at reduced exposure until the system seems more in tune with the markets. Good luck Traders!

Thursday, July 2, 2009

June Totals

The total return for June using the system's suggested allocations was spx 10.8%....rut 12.5%....and the eem 15.8%.

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

Monday's call 7-03-09

The call for Monday is to switch short.

Will trade the spx at 0.3x

Enjoy your Holiday weekend!!

Will trade the spx at 0.3x

Enjoy your Holiday weekend!!

Wednesday, July 1, 2009

Tuesday, June 30, 2009

Monday, June 29, 2009

Tuesday's call

the call is to be long tomorrow unless the spx closes above 928.09.

Will trade spx at 1.5x.

Will trade spx at 1.5x.

Returns for week ending 6-26.

After a good day Monday I considered going to cash for the rest of the week. In hindsight that would have been right.

It would appear looking at my chart of returns, that following the eem or the systems calls at full allocation would have been the best overall, however if the system were to have some consecutive negative weeks I would expect the more conservative spx or sys @ allocation to gain ground. I may try to allocate more if the system continues to perform well.

Friday, June 26, 2009

Monday's call 6-29-09

The call is to be short if the spx closes above 920.72.

Will trade the spx at 1.75x.

The call ended up long for Monday.

Will trade the spx at 1.75x.

The call ended up long for Monday.

Thursday, June 25, 2009

Wednesday, June 24, 2009

Thursday's Call.

Well that did not work out well.

The call for tomorrow is to stay short unless the rut closes below 493.79.

Will trade the rut at 2x.

The call for tomorrow is to stay short unless the rut closes below 493.79.

Will trade the rut at 2x.

Tuesday, June 23, 2009

Monday, June 22, 2009

Returns for week ending 6-19.

The systems returns for the week ending 6-19 were system spx 3.74% ......rut 5.00% ....and eem 2.75% using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 4.2%, 6.0% and 2.5% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 42.6% ....rut 63.9% .....eem 122.9% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.2% and at full 2x...98.5%.

Following the sys calls as they switched from one index to another reduced our gains somewhat in contrast to staying with a single index. I am posting a chart of the recent returns of the system. Overall the eem is still the leader, being more volatile, but if the system were to have a poor spell then having less exposure should help. Of course I am not expecting any poor spells ;>)

Friday, June 19, 2009

Monday's call 6-22-09

The call is to be short for Monday.

I am trading the rut at 2x. I think I will back down to 1.5x for Monday. some talk of pressuring the shorts. We shall see.

I am trading the rut at 2x. I think I will back down to 1.5x for Monday. some talk of pressuring the shorts. We shall see.

Thursday, June 18, 2009

Friday's call.

the system is calling to be long if the eem closes between 31.41 and 31.70. EDIT if the eem finishes above 31.41 I will go long

The signal may change if the market moves much. I will update.

Will trade the eem at 0.5x. Will trade at reduced exposure for tomorrow, in part that is the systems call and because it may be difficult to determine the exact call before market close.

The signal may change if the market moves much. I will update.

Will trade the eem at 0.5x. Will trade at reduced exposure for tomorrow, in part that is the systems call and because it may be difficult to determine the exact call before market close.

Wednesday, June 17, 2009

Thursday's Call.

The system will switch short if the eem cloes between 31.77 and 32.06.

I will trade emerging markets at 1.5x if the call is long and 1x if the call is short.

ended up long for tomorrow.

I will trade emerging markets at 1.5x if the call is long and 1x if the call is short.

ended up long for tomorrow.

Tuesday, June 16, 2009

Monday, June 15, 2009

Returns for week ending 6-12.

The systems returns for the week ending 6-12 were spx(-0.12%) ......rut 0.74% ....and eem 6.78% using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been (-0.1%), 1.4% and 9.2% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 36.9% ....rut 54.0% .....eem 117.5% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.8% and at full 2x...93.3%.

As it turned out the systems calls were to follow the rut, but if one had followed the eem, returns would have been better. As mentioned last week, if the eem correlates well with domestic markets and the system is performing well then trading the eem should be good for returns. However last week the systems calls were mixed in success in regards to the rut and the eem actually did not follow the domestic markets on wednesday and Friday which helped the eem's returns. My inclination is to continue to follow which ever fund the system indicates...time will tell.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been (-0.1%), 1.4% and 9.2% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 36.9% ....rut 54.0% .....eem 117.5% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.8% and at full 2x...93.3%.

As it turned out the systems calls were to follow the rut, but if one had followed the eem, returns would have been better. As mentioned last week, if the eem correlates well with domestic markets and the system is performing well then trading the eem should be good for returns. However last week the systems calls were mixed in success in regards to the rut and the eem actually did not follow the domestic markets on wednesday and Friday which helped the eem's returns. My inclination is to continue to follow which ever fund the system indicates...time will tell.

Friday, June 12, 2009

Monday's call 6-15-09

The call is to be short for Monday if the rut closes above 521.35

Will trade rut at 1.75x.

Will trade rut at 1.75x.

Thursday, June 11, 2009

Wednesday, June 10, 2009

Thursday's Call.

the call is to stay long if we close below 523.18 on the rut.

will go to 1.25x and trade rut.

The signal ended indicating to be short for tomorrow. as it closed near the pivot it would have been hard to get positioned correctly. On occasion the market closes very near the pivot and it would probably be best to go to cash or a much reduced position. As far as keeping track of the systems gains I will count tomorrow as a wash.

will go to 1.25x and trade rut.

The signal ended indicating to be short for tomorrow. as it closed near the pivot it would have been hard to get positioned correctly. On occasion the market closes very near the pivot and it would probably be best to go to cash or a much reduced position. As far as keeping track of the systems gains I will count tomorrow as a wash.

Tuesday, June 9, 2009

Wednesday's call

The system is calling to be short if the rut closes above 529.09.

will stay at 1.5x and trade rut.

Ended up long for Wednesday.

will stay at 1.5x and trade rut.

Ended up long for Wednesday.

Monday, June 8, 2009

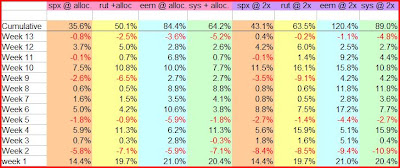

Returns for week ending 6-05.

The systems returns for the week ending 6-05 were 7.47% - spx .....10.80% - rut....and 9.98%-eem using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 11.53%, 16.11% and 15.84% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 31.9% ....rut 45.5% .....eem 99.2% if trading 2x funds.

As I mentioned last week I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 72.5% and at full 2x...90.7%. At this point just trading the eem would bring the best results but that is because the eem is the most volatile....if the system has a period of poor calls then the eem will suffer the most, so I am expecting following the systems calls as to which index to trade should do better or equally. Tho, when the eem correlates well to the domestic markets then trading the eem could do best.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 11.53%, 16.11% and 15.84% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 31.9% ....rut 45.5% .....eem 99.2% if trading 2x funds.

As I mentioned last week I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 72.5% and at full 2x...90.7%. At this point just trading the eem would bring the best results but that is because the eem is the most volatile....if the system has a period of poor calls then the eem will suffer the most, so I am expecting following the systems calls as to which index to trade should do better or equally. Tho, when the eem correlates well to the domestic markets then trading the eem could do best.

Friday, June 5, 2009

Monday's call 6-08-09

The call for Monday is to go short unless the adre closes above 36.35.

Will trade the rut if short and emerging markets if the call is long at 1.25x.

Will trade the rut if short and emerging markets if the call is long at 1.25x.

Thursday, June 4, 2009

Friday's call.

The call is to stay long if the rut closes below 527.0.

Will go to 1.25x and trade rut.

If the current trend continues will be short for tomorrow.

Will go to 1.25x and trade rut.

If the current trend continues will be short for tomorrow.

Wednesday, June 3, 2009

Tuesday, June 2, 2009

Monday, June 1, 2009

May Totals

The total return for May using the system's suggested allocations was spx 4.5%....rut -0.6%....and the eem 44.6%. The reason for the range in trading the different indexes is that generally the eem is much more volatile than domestic markets and also that the systems signals have been following the emerging markets recently, as I indicated last week.

The emerging markets do not track domestic markets exactly...on certain days they will be up and we will be down, so the system should do better (as evidenced last week) if trading the index that the system is tracking at the moment. I will add that info daily as well as allocation suggestions to see if either help the returns.

Also monthly and possibly weekly I will track and post the systems accumulated returns as the system switches indexes. Since first posting here 2 mo. ago, the system had returns of 60.2% at allocation and 72.2% at full 2x if one had traded the rut and then the eem (from 5/12 when the system switched).

The emerging markets do not track domestic markets exactly...on certain days they will be up and we will be down, so the system should do better (as evidenced last week) if trading the index that the system is tracking at the moment. I will add that info daily as well as allocation suggestions to see if either help the returns.

Also monthly and possibly weekly I will track and post the systems accumulated returns as the system switches indexes. Since first posting here 2 mo. ago, the system had returns of 60.2% at allocation and 72.2% at full 2x if one had traded the rut and then the eem (from 5/12 when the system switched).

Returns for week ending 5-29.

The systems returns for the week ending 5-29 were -2.56% and -6.48% for the spx and rut using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been -3.5% and -9.1% respectively.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 4.2%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. Last week I traded the emerging markets. this payed off as I had a gain instead of a loss.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 22.8% ....rut 31.3% .....eem 71.9% if trading 2x funds.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been -3.5% and -9.1% respectively.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 4.2%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. Last week I traded the emerging markets. this payed off as I had a gain instead of a loss.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 22.8% ....rut 31.3% .....eem 71.9% if trading 2x funds.

Friday, May 29, 2009

Monday's call 6-01-09

Will stay Long if the adre closes above 35.29.

going to 1.75x with the emerging markets.

going to 1.75x with the emerging markets.

Thursday, May 28, 2009

Friday's call.

The system will stay long if the adre closes above 35.36.

Will go to 1X with emerging markets.

Will go to 1X with emerging markets.

Wednesday, May 27, 2009

Thursday's Call.

We will stay long if the eem closes below 32.50.

Staying at 1.5x and trading emerging markets.

Staying at 1.5x and trading emerging markets.

Tuesday, May 26, 2009

Wednesday's call

Will be long for tomorrow if the eem closes above 32.05.

Will go to 1.5x, and trade the Emerging Markets.

Will go to 1.5x, and trade the Emerging Markets.

Returns for week ending 5-22.

The systems returns for the week ending 5-08 were 0.56% and 0.48% for the spx and rut using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 0.82% and 0.56% respectively. Another flat week.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with 2x leverage would be 27.3% and 44.0%.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 11.8%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. I am sure that the difference in returns of trading domestic vs. emerging market funds will not generally be this dramatic. I may post which I consider is currently best to trade and see how that plays out.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 0.82% and 0.56% respectively. Another flat week.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with 2x leverage would be 27.3% and 44.0%.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 11.8%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. I am sure that the difference in returns of trading domestic vs. emerging market funds will not generally be this dramatic. I may post which I consider is currently best to trade and see how that plays out.

Friday, May 22, 2009

Tuesday's call 5-26-09

the call is to be short for next Tuesday.

Will stay at 1.25x. Have a nice weekend!

Will stay at 1.25x. Have a nice weekend!

Thursday, May 21, 2009

Wednesday, May 20, 2009

Tuesday, May 19, 2009

Wednesday's call

The system will stay long if the adre closes between 33.97 and 34.93.

Will go to 1.75x.

Will go to 1.75x.

Monday, May 18, 2009

Returns for week ending 5-15.

The systems returns for the week ending 5-08 were 1.57% and 1.51% for the spx and rut using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 0.81% and 0.51% respectively. Pretty much a flat week.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with 2x leverage would be 26.2% and 43.2%.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 0.81% and 0.51% respectively. Pretty much a flat week.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with 2x leverage would be 26.2% and 43.2%.

Friday, May 15, 2009

Thursday, May 14, 2009

Friday's call.

The system is staying short for tomorrow.

Will go to 1.75x.

Wish I had followed your lead, Jim, at this point.

Will go to 1.75x.

Wish I had followed your lead, Jim, at this point.

Wednesday, May 13, 2009

Thursday's Call.

the system says another down day for tomorrow.

Will go to 1.5x.

It might pay to trade something tracking emerging markets as they will probably react badly overnight to the domestic move today.

Will go to 1.5x.

It might pay to trade something tracking emerging markets as they will probably react badly overnight to the domestic move today.

Tuesday, May 12, 2009

Monday, May 11, 2009

Tuesday's call

the system will stay long for Tuesday provided the eem closes below 31.31.

Will go to 1.75x.

Will go to 1.75x.

Returns for week ending 5-08.

The systems returns for the week ending 5-08 were 5.00% and 4.24% for the spx and rut using the systems variable allocation adjustments.

If one had traded the Direxion funds that track these two indexes at full allocation the returns could have been 10.93% and 9.21% respectively.

Obviously when the system is right in its calls then being all in will generate much better returns.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with direxion would be 22% and 37%.

If one had traded the Direxion funds that track these two indexes at full allocation the returns could have been 10.93% and 9.21% respectively.

Obviously when the system is right in its calls then being all in will generate much better returns.

Since first starting this blog, over a month ago, the cumulative gains for the spx and rut trading with direxion would be 22% and 37%.

Friday, May 8, 2009

Thursday, May 7, 2009

Friday's call.

the call is to stay short unless the spx closes between 913.28 and 919.99.

Who woulda thunk...made some money on the short side?

Will go to 1.5x.

Who woulda thunk...made some money on the short side?

Will go to 1.5x.

Wednesday, May 6, 2009

Thursday's Call.

the system is calling to be on the short side tomorrow if the spx closes above 915.73.

One might think that could happen (market retracing) as the market participants have been waiting for the bank announcement tomorrow (thinking it will be negative) and we have been on a tear recently..... a lot of traders have been anticipating a pullback for some time, but there is a lot of money on the sidelines trying to pick a spot to re-enter; so lately it has not been good for short term profits to be short. If the system calls for short or long I will go at 1x.

Ended mostly short in my accounts for tomorrow.

One might think that could happen (market retracing) as the market participants have been waiting for the bank announcement tomorrow (thinking it will be negative) and we have been on a tear recently..... a lot of traders have been anticipating a pullback for some time, but there is a lot of money on the sidelines trying to pick a spot to re-enter; so lately it has not been good for short term profits to be short. If the system calls for short or long I will go at 1x.

Ended mostly short in my accounts for tomorrow.

Tuesday, May 5, 2009

Wednesday's call

The system will switch back to long side for Wednesday providing the spx closes below 907.69.

Will go to 1x.

Will go to 1x.

Monday, May 4, 2009

Tuesday's call

The system is forecasting the market to pullback tomorrow.

Probably a little risky to short this market.

Will stay at 1.5x.

Probably a little risky to short this market.

Will stay at 1.5x.

Friday, May 1, 2009

Forecaster system's recent returns.

As I posted a few days ago I have been watching and personally trading funds that track the RUT index as it is more volatile recently. If you had traded it using Direxion Fund pair DXRLX/DXRSX, the Month of April would have returned 15.30% at full allocation and 15.04% using my posted allocation adjustments.

Trading the spx would have returned -0.31% at full alloc. and 2.82% with adjusted alloc. for the month of April ...so the adjustment saved a little with the spx and lost some with the rut.

At this time my allocation adjustments are mostly by the seat of the pant....I have not worked out a mechanical adjustment yet.

If one had followed my system calls for March and April, the best Possible returns would have been 55.5% and 97.8% on the SPX and RUT respectively. Not too bad....tho as I stated earlier February sucked. I have done a major overhaul since then tho I wouldn't attribute all of the recent gains to that work, as the majority (of recent returns) is just the system going thru hot and cold spells. I will continue to work on fine tuning the system. Good luck to any traders trying to predict this market!

Trading the spx would have returned -0.31% at full alloc. and 2.82% with adjusted alloc. for the month of April ...so the adjustment saved a little with the spx and lost some with the rut.

At this time my allocation adjustments are mostly by the seat of the pant....I have not worked out a mechanical adjustment yet.

If one had followed my system calls for March and April, the best Possible returns would have been 55.5% and 97.8% on the SPX and RUT respectively. Not too bad....tho as I stated earlier February sucked. I have done a major overhaul since then tho I wouldn't attribute all of the recent gains to that work, as the majority (of recent returns) is just the system going thru hot and cold spells. I will continue to work on fine tuning the system. Good luck to any traders trying to predict this market!

April's returns.

The total for the month was 2.28%

The week ending 5-1-09; The system returned -1.80%

The week ending 4-24-09; The system returned 5.90%

The week ending 4-17-09; The system returned 0.67%

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

The week ending 5-1-09; The system returned -1.80%

The week ending 4-24-09; The system returned 5.90%

The week ending 4-17-09; The system returned 0.67%

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

Monday's call 5-04-09

The system will switch long unless the spx closes above 884.33.

Will be at 1.5x.

Will be at 1.5x.

Thursday, April 30, 2009

Friday's call.

The system will stay short unless the sp500 closes between 867.70 and 874.08.

Will be at 1.75x.

Since the market moved around my signal point at close I made a judgment call and personally stayed short. Good luck!

I will count tomorrow as a wash, in regards to returns reported, since the signal was not clear.

Will be at 1.75x.

Since the market moved around my signal point at close I made a judgment call and personally stayed short. Good luck!

I will count tomorrow as a wash, in regards to returns reported, since the signal was not clear.

Wednesday, April 29, 2009

Tuesday, April 28, 2009

Wednesday's call

Will stay long if the rut closes above 475.16.

Will go to 1.25x.

Looks like I will be short for tomorrow.

Will go to 1.25x.

Looks like I will be short for tomorrow.

Monday, April 27, 2009

Tuesday's call

The system will switch to the long side provided the rut closes below 472.80.

Will stay at 1X.

Will stay at 1X.

What if scenarios.

I have been posting the systems returns as if one had traded some medium tracking the spx. But I have noticed that the rut has been much more volatile than the spx, so I have been trading a portion of my portfolio in funds etc. that track the rut. for example if last week you had traded the rut using the systems calls you could have netted roughly 11.25% gains vs. 5.90% for the spx. If you had traded something with more leverage such as 2.5x direxion funds or maybe 3x etf's you could have netted maybe plus 20% by staying fully leveraged instead of varying your exposure as I have posted.

Of course if the system had an off week then most likely trading the rut would incur larger losses. This is part of the dilemma of forecasting the market. To have great returns it would help to have a good system and also be able to predict when that system will be hot and when to back off. Not an easy task to say the least!

Systems return's

The week ending 4-24-09; The system returned 5.90%

The week ending 4-17-09; The system returned 0.67%

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

The week ending 4-17-09; The system returned 0.67%

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

Friday, April 24, 2009

Thursday, April 23, 2009

Friday's call.

the system is staying short for Friday unless the rut closes below 464.87.

Staying at .75x

Looking as tho I will be short for tomorrow.

Staying at .75x

Looking as tho I will be short for tomorrow.

Wednesday, April 22, 2009

Thursday's Call.

The system will stay long unless the rut (Russell 2000 index) closes below 475.69.

Staying at .75x.

Looking like I may be short tomorrow if these (3:43) levels hold.

Staying at .75x.

Looking like I may be short tomorrow if these (3:43) levels hold.

Tuesday, April 21, 2009

Monday, April 20, 2009

Systems return's

The week ending 4-17-09; The system returned 0.67%

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

The week ending 4-9-09: the system would have returned -5.8%.

The week ending 4-3-09; the system would have returned 14.4% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

Friday, April 17, 2009

Thursday, April 16, 2009

Friday's call.

The system is staying short unless the dji index closes below 8081.81.

Will be at 1.5x allocation.

Am short for Friday.

Will be at 1.5x allocation.

Am short for Friday.

Wednesday, April 15, 2009

Thursday's Call.

The system is staying long if the dji index closes between 7925.57 and 7979.58.

Staying 1x invested.

AS the dow closed I will be short for tomorrow, not sure if that will be the right call, but we are due for a pullback.

Staying 1x invested.

AS the dow closed I will be short for tomorrow, not sure if that will be the right call, but we are due for a pullback.

Tuesday, April 14, 2009

Systems return's

The week ending 4-9-09: the system would have returned -5.69%.

The week ending 4-3-09; the system would have returned 13.26% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

The week ending 4-3-09; the system would have returned 13.26% if trading the spx at 2x leverage.

These are hypothetical returns of the system's calls as posted here. They are calculated on the amount of leverage posted and the spx index (S&P 500) daily percent moves. I will post allocation amount if other than 2x leverage.

Monday, April 13, 2009

Tuesday's call

the system is calling for a long position if the dji index closes above 8087.42. Staying at 1x. the system will be short for tomorrow as the markets closed.

Thursday, April 9, 2009

Wednesday, April 8, 2009

Tuesday, April 7, 2009

Wednesday's call

The call is to stay long provided the rut stays below 443.53.

I will be reducing my exposure to 1x.

I will be reducing my exposure to 1x.

Monday, April 6, 2009

Friday, April 3, 2009

Monday's call 4-06-09

The call for Monday is to switch short if the rut (Russell 2000) index closes above 453.88.

Thursday, April 2, 2009

Friday's call.

The system expects the market to continue up tomorrow. This call is emanating from the ndx system for those that have been following for a period.

Forecaster system's recent returns.

The forecaster trading system has been overall, a very profitable guide for my trading. Last year I did very well using its calls but this year it has had mixed results. February was not a good month.... March has made up for its losses. If one had traded, for example, the combo DXELX/DXESX Marches return would have been 60.29%, however February returns would have been -47.7%. So you can see this system can be volatile.

After February's losses I have modified the system to hopefully better handle periods of poor returns. I am looking at methods to reduce exposure during certain periods to help limit drawdowns, but have not been too successful yet. Some systems lower exposure when volatility goes up, but so far when volatility has gone up my returns go up; so this will not help my system. Most methods to reduce drawdown also reduce total gains over time so I am not exactly happy with these solutions.

After February's losses I have modified the system to hopefully better handle periods of poor returns. I am looking at methods to reduce exposure during certain periods to help limit drawdowns, but have not been too successful yet. Some systems lower exposure when volatility goes up, but so far when volatility has gone up my returns go up; so this will not help my system. Most methods to reduce drawdown also reduce total gains over time so I am not exactly happy with these solutions.

Wednesday, April 1, 2009

Tuesday, March 31, 2009

Wednesday 4/1/09 Call.

The system is switching short for tomorrow. Not sure if that will be the right call but will follow in my personal accounts.

Monday, March 30, 2009

Friday, March 27, 2009

Thursday, March 26, 2009

Subscribe to:

Comments (Atom)