the call is to be long for Monday.

Will trade emerging markets at 1.5x.

Friday, July 31, 2009

Thursday, July 30, 2009

Friday's call.

The call is to stay short. Not that it is working too well today.

Will trade spx at 1.25x.

Well I was obviously wrong about buyers waiting for more pullback. However that was just an opinion to support the systems position. The system is mechanical, and I follow it's calls....if I feel strongly that it may be wrong I only reduce the calls exposure. Hoping for some profit taking tomorrow.

Will trade spx at 1.25x.

Well I was obviously wrong about buyers waiting for more pullback. However that was just an opinion to support the systems position. The system is mechanical, and I follow it's calls....if I feel strongly that it may be wrong I only reduce the calls exposure. Hoping for some profit taking tomorrow.

Wednesday, July 29, 2009

Thursday's Call.

The call is to be short for tomorrow unless the dji closes above 9037.6 or the spx closes below 966.4.

Edit: I will go short unless the rut closes below 547.4.

I am positioned short for tomorrow. This market still has people looking for pullbacks on which to enter. But I think we should get some more downside before too many buy again.

Will trade at 1.75x the spx.

Edit: I will go short unless the rut closes below 547.4.

I am positioned short for tomorrow. This market still has people looking for pullbacks on which to enter. But I think we should get some more downside before too many buy again.

Will trade at 1.75x the spx.

Tuesday, July 28, 2009

Wednesday's call

the call is to switch long unless the spx closes below 975.5.

I will trade the spx at 1.5x.

I will trade the spx at 1.5x.

Monday, July 27, 2009

Tuesday's call

the call is to stay short unless the ndx closes below 1591.06.

will trade the ndx at 1.75x.

will trade the ndx at 1.75x.

Friday, July 24, 2009

Monday's call 7-27-09

The call is to stay short if the ndx closes below 1609.53.

Will trade the ndx at 1.5x.

Will trade the ndx at 1.5x.

Thursday, July 23, 2009

Wednesday, July 22, 2009

Thursday's Call.

The call is to switch long if the ndx closes above 1560.78.

I will trade the ndx at 1x.

I will trade the ndx at 1x.

Tuesday, July 21, 2009

Wednesday's call

The call is to stay long unless the spx closes positive.

Will trade the ndx at 1.5x.

ended up short side for Wednesday.

Will trade the ndx at 1.5x.

ended up short side for Wednesday.

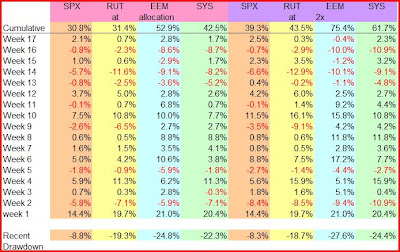

Returns for week ending 7-17.

Monday, July 20, 2009

Tuesday's call

Will be long for tomorrow unless the ndx closes below 1534.90.

will trade the ndx at 1.25x.

will trade the ndx at 1.25x.

Friday, July 17, 2009

Monday's call 7-20-09

the call is to switch short if the ndx closes in positive territory.

Will trade the ndx at 0.3x.

Will trade the ndx at 0.3x.

Thursday, July 16, 2009

Wednesday, July 15, 2009

Thursday's Call.

Ouch! Not fun to be wrong on a big day.

Will switch to long side at 0.3x and trade the eem.

Will switch to long side at 0.3x and trade the eem.

Tuesday, July 14, 2009

Wednesday's call

Will stay short unless the eem closes below 31.09.

will trade emerging markets 1.5x.

will trade emerging markets 1.5x.

Monday, July 13, 2009

Returns for week ending 7-10.

Tuesday's call

The call will be to switch short unless the eem closes below 30.66.

I will trade the eem at 1.5x.

I will trade the eem at 1.5x.

Friday, July 10, 2009

Thursday, July 9, 2009

Friday's call.

the call is to be long tomorrow.

Will trade the emerging markets at 0.3x.

Edit: if the dji closes negative will go short the eem at 1.5x.

Since the Dow Jones was flipping positive negative at close, I personally ended up going short but will not count it toward system's gains or losses.

Will trade the emerging markets at 0.3x.

Edit: if the dji closes negative will go short the eem at 1.5x.

Since the Dow Jones was flipping positive negative at close, I personally ended up going short but will not count it toward system's gains or losses.

Wednesday, July 8, 2009

Thursday's Call.

The call is to stay long unless the rut closes above 478.25.

Will trade the rut at 1.75x.

May end up short for tomorrow unless we fall back some.

Short it is.

Will trade the rut at 1.75x.

May end up short for tomorrow unless we fall back some.

Short it is.

Tuesday, July 7, 2009

Monday, July 6, 2009

Tuesday's call

If the dji and spx finish positive the call is to be 1x short.

IF the dji is positive and spx negative at close the call is long at 0.3x.

If both close negative then the call is 0.3x short.

How's that for confusing?

Will trade the spx.

Ended up short for tomorrow.

IF the dji is positive and spx negative at close the call is long at 0.3x.

If both close negative then the call is 0.3x short.

How's that for confusing?

Will trade the spx.

Ended up short for tomorrow.

Returns for week ending 7-03.

Returns for last week were not of the sort that I would like to see. I guess one can't expect to be right all the time, but after two negative weeks I definitely would like the coming week to have some gains. I will most likely trade at reduced exposure until the system seems more in tune with the markets. Good luck Traders!

Thursday, July 2, 2009

June Totals

The total return for June using the system's suggested allocations was spx 10.8%....rut 12.5%....and the eem 15.8%.

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

The system's returns for the month of June as it followed the different indexes at the suggested allocations produced 5.8%.

If one had followed the calls at a full 2x. The returns were 17.9% for the spx.....22.1% for the rut.....27.1% for the eem .....and 13.1%. for the systems switches.

Staying at 2x or just picking an index and using the long short signals would have returned the best. This is to be expected if the system has a profitable spell however if it has a period of drawdown then I would expect a lesser allocation to do better tho that was not the case last week. We shall see what this month has to bring...so far not doing too well. Good luck all!

Monday's call 7-03-09

The call for Monday is to switch short.

Will trade the spx at 0.3x

Enjoy your Holiday weekend!!

Will trade the spx at 0.3x

Enjoy your Holiday weekend!!

Wednesday, July 1, 2009

Subscribe to:

Comments (Atom)