the call is to go short unless the rut closes below 506.01.

Will trade rut at 2x.

Tuesday, June 30, 2009

Monday, June 29, 2009

Tuesday's call

the call is to be long tomorrow unless the spx closes above 928.09.

Will trade spx at 1.5x.

Will trade spx at 1.5x.

Returns for week ending 6-26.

After a good day Monday I considered going to cash for the rest of the week. In hindsight that would have been right.

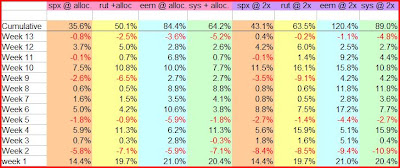

It would appear looking at my chart of returns, that following the eem or the systems calls at full allocation would have been the best overall, however if the system were to have some consecutive negative weeks I would expect the more conservative spx or sys @ allocation to gain ground. I may try to allocate more if the system continues to perform well.

Friday, June 26, 2009

Monday's call 6-29-09

The call is to be short if the spx closes above 920.72.

Will trade the spx at 1.75x.

The call ended up long for Monday.

Will trade the spx at 1.75x.

The call ended up long for Monday.

Thursday, June 25, 2009

Wednesday, June 24, 2009

Thursday's Call.

Well that did not work out well.

The call for tomorrow is to stay short unless the rut closes below 493.79.

Will trade the rut at 2x.

The call for tomorrow is to stay short unless the rut closes below 493.79.

Will trade the rut at 2x.

Tuesday, June 23, 2009

Monday, June 22, 2009

Returns for week ending 6-19.

The systems returns for the week ending 6-19 were system spx 3.74% ......rut 5.00% ....and eem 2.75% using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 4.2%, 6.0% and 2.5% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 42.6% ....rut 63.9% .....eem 122.9% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.2% and at full 2x...98.5%.

Following the sys calls as they switched from one index to another reduced our gains somewhat in contrast to staying with a single index. I am posting a chart of the recent returns of the system. Overall the eem is still the leader, being more volatile, but if the system were to have a poor spell then having less exposure should help. Of course I am not expecting any poor spells ;>)

Friday, June 19, 2009

Monday's call 6-22-09

The call is to be short for Monday.

I am trading the rut at 2x. I think I will back down to 1.5x for Monday. some talk of pressuring the shorts. We shall see.

I am trading the rut at 2x. I think I will back down to 1.5x for Monday. some talk of pressuring the shorts. We shall see.

Thursday, June 18, 2009

Friday's call.

the system is calling to be long if the eem closes between 31.41 and 31.70. EDIT if the eem finishes above 31.41 I will go long

The signal may change if the market moves much. I will update.

Will trade the eem at 0.5x. Will trade at reduced exposure for tomorrow, in part that is the systems call and because it may be difficult to determine the exact call before market close.

The signal may change if the market moves much. I will update.

Will trade the eem at 0.5x. Will trade at reduced exposure for tomorrow, in part that is the systems call and because it may be difficult to determine the exact call before market close.

Wednesday, June 17, 2009

Thursday's Call.

The system will switch short if the eem cloes between 31.77 and 32.06.

I will trade emerging markets at 1.5x if the call is long and 1x if the call is short.

ended up long for tomorrow.

I will trade emerging markets at 1.5x if the call is long and 1x if the call is short.

ended up long for tomorrow.

Tuesday, June 16, 2009

Monday, June 15, 2009

Returns for week ending 6-12.

The systems returns for the week ending 6-12 were spx(-0.12%) ......rut 0.74% ....and eem 6.78% using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been (-0.1%), 1.4% and 9.2% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 36.9% ....rut 54.0% .....eem 117.5% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.8% and at full 2x...93.3%.

As it turned out the systems calls were to follow the rut, but if one had followed the eem, returns would have been better. As mentioned last week, if the eem correlates well with domestic markets and the system is performing well then trading the eem should be good for returns. However last week the systems calls were mixed in success in regards to the rut and the eem actually did not follow the domestic markets on wednesday and Friday which helped the eem's returns. My inclination is to continue to follow which ever fund the system indicates...time will tell.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been (-0.1%), 1.4% and 9.2% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 36.9% ....rut 54.0% .....eem 117.5% if trading 2x funds.

As I mentioned earlier I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 73.8% and at full 2x...93.3%.

As it turned out the systems calls were to follow the rut, but if one had followed the eem, returns would have been better. As mentioned last week, if the eem correlates well with domestic markets and the system is performing well then trading the eem should be good for returns. However last week the systems calls were mixed in success in regards to the rut and the eem actually did not follow the domestic markets on wednesday and Friday which helped the eem's returns. My inclination is to continue to follow which ever fund the system indicates...time will tell.

Friday, June 12, 2009

Monday's call 6-15-09

The call is to be short for Monday if the rut closes above 521.35

Will trade rut at 1.75x.

Will trade rut at 1.75x.

Thursday, June 11, 2009

Wednesday, June 10, 2009

Thursday's Call.

the call is to stay long if we close below 523.18 on the rut.

will go to 1.25x and trade rut.

The signal ended indicating to be short for tomorrow. as it closed near the pivot it would have been hard to get positioned correctly. On occasion the market closes very near the pivot and it would probably be best to go to cash or a much reduced position. As far as keeping track of the systems gains I will count tomorrow as a wash.

will go to 1.25x and trade rut.

The signal ended indicating to be short for tomorrow. as it closed near the pivot it would have been hard to get positioned correctly. On occasion the market closes very near the pivot and it would probably be best to go to cash or a much reduced position. As far as keeping track of the systems gains I will count tomorrow as a wash.

Tuesday, June 9, 2009

Wednesday's call

The system is calling to be short if the rut closes above 529.09.

will stay at 1.5x and trade rut.

Ended up long for Wednesday.

will stay at 1.5x and trade rut.

Ended up long for Wednesday.

Monday, June 8, 2009

Returns for week ending 6-05.

The systems returns for the week ending 6-05 were 7.47% - spx .....10.80% - rut....and 9.98%-eem using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 11.53%, 16.11% and 15.84% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 31.9% ....rut 45.5% .....eem 99.2% if trading 2x funds.

As I mentioned last week I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 72.5% and at full 2x...90.7%. At this point just trading the eem would bring the best results but that is because the eem is the most volatile....if the system has a period of poor calls then the eem will suffer the most, so I am expecting following the systems calls as to which index to trade should do better or equally. Tho, when the eem correlates well to the domestic markets then trading the eem could do best.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been 11.53%, 16.11% and 15.84% respectively.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 31.9% ....rut 45.5% .....eem 99.2% if trading 2x funds.

As I mentioned last week I will post the systems returns as if one had traded the signals and switched indexes per system calls. Sys. at allocation 72.5% and at full 2x...90.7%. At this point just trading the eem would bring the best results but that is because the eem is the most volatile....if the system has a period of poor calls then the eem will suffer the most, so I am expecting following the systems calls as to which index to trade should do better or equally. Tho, when the eem correlates well to the domestic markets then trading the eem could do best.

Friday, June 5, 2009

Monday's call 6-08-09

The call for Monday is to go short unless the adre closes above 36.35.

Will trade the rut if short and emerging markets if the call is long at 1.25x.

Will trade the rut if short and emerging markets if the call is long at 1.25x.

Thursday, June 4, 2009

Friday's call.

The call is to stay long if the rut closes below 527.0.

Will go to 1.25x and trade rut.

If the current trend continues will be short for tomorrow.

Will go to 1.25x and trade rut.

If the current trend continues will be short for tomorrow.

Wednesday, June 3, 2009

Tuesday, June 2, 2009

Monday, June 1, 2009

May Totals

The total return for May using the system's suggested allocations was spx 4.5%....rut -0.6%....and the eem 44.6%. The reason for the range in trading the different indexes is that generally the eem is much more volatile than domestic markets and also that the systems signals have been following the emerging markets recently, as I indicated last week.

The emerging markets do not track domestic markets exactly...on certain days they will be up and we will be down, so the system should do better (as evidenced last week) if trading the index that the system is tracking at the moment. I will add that info daily as well as allocation suggestions to see if either help the returns.

Also monthly and possibly weekly I will track and post the systems accumulated returns as the system switches indexes. Since first posting here 2 mo. ago, the system had returns of 60.2% at allocation and 72.2% at full 2x if one had traded the rut and then the eem (from 5/12 when the system switched).

The emerging markets do not track domestic markets exactly...on certain days they will be up and we will be down, so the system should do better (as evidenced last week) if trading the index that the system is tracking at the moment. I will add that info daily as well as allocation suggestions to see if either help the returns.

Also monthly and possibly weekly I will track and post the systems accumulated returns as the system switches indexes. Since first posting here 2 mo. ago, the system had returns of 60.2% at allocation and 72.2% at full 2x if one had traded the rut and then the eem (from 5/12 when the system switched).

Returns for week ending 5-29.

The systems returns for the week ending 5-29 were -2.56% and -6.48% for the spx and rut using the systems variable allocation adjustments.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been -3.5% and -9.1% respectively.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 4.2%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. Last week I traded the emerging markets. this payed off as I had a gain instead of a loss.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 22.8% ....rut 31.3% .....eem 71.9% if trading 2x funds.

If one had traded a 2x fund that tracked these two indexes at full allocation the returns could have been -3.5% and -9.1% respectively.

On the other hand if you had traded a 2x entity tracking the eem, last weeks returns would have been 4.2%. In this instance it would have payed off to follow the systems calls and traded a fund or ETF tracking the eem and adre. Last week I traded the emerging markets. this payed off as I had a gain instead of a loss.

Since first starting this blog, over 2 months ago, the cumulative gains for the indexes I follow would be... spx 22.8% ....rut 31.3% .....eem 71.9% if trading 2x funds.

Subscribe to:

Comments (Atom)