The call is to switch short.

I will trade the spx at 1.75x.

Volatility returning to the market place...it may be prudent to reduce exposure.

Friday, October 30, 2009

Thursday, October 29, 2009

Friday's call.

The call is to switch long if the rut closes above 573.44.....however if the eem closes above 39.51 then the call will be reversed.

I will trade the rut at 1.25x.

Ended up long but at reduced exposure...could be an up day as it is the end of the month.

I will trade the rut at 1.25x.

Ended up long but at reduced exposure...could be an up day as it is the end of the month.

Wednesday, October 28, 2009

Tuesday, October 27, 2009

Wednesday's call

The call is to switch long if the rut closes between 590.71 and 594.08.....the qualifier is to go opposite the call if the eem closes between 40.07 and 40.99.

I will trade the rut at 1.75x.

Staying short.

I will trade the rut at 1.75x.

Staying short.

Monday, October 26, 2009

Tuesday's call

The call is to switch long unless the spx closes above 1072.26.....however the call will have a qualifier to go opposite the call if the eem closes between 40.12 and 41.04.

I will trade rut at 2x.

I will trade rut at 2x.

Friday, October 23, 2009

Monday's call 10-26-09

the call is to stay long if the rut closes below 604.49. However there is a qualifying condition that should be checked....If the eem closes between 40.08 and 41.00 then the call's direction will be switched.

I will trade the rut at 2x.

Am posting early as I need to do some errands.

Looks like we will be short for Monday.

I will trade the rut at 2x.

Am posting early as I need to do some errands.

Looks like we will be short for Monday.

Thursday, October 22, 2009

Friday's call.

The call is to switch long unless the eem closes below 40.90.

I will trade emerging markets at 2x.

I will trade emerging markets at 2x.

Wednesday, October 21, 2009

Tuesday, October 20, 2009

Wednesday's call

The call is to stay short unless the adre closes above 44.58.

I will trade the emerging markets at 1.75x

I am posting early as I may not have access to internet later today.

I will trade the emerging markets at 1.75x

I am posting early as I may not have access to internet later today.

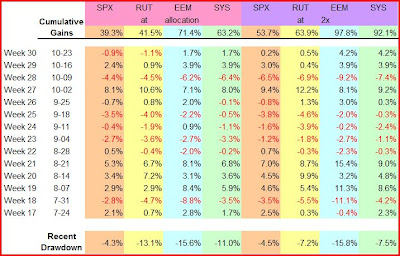

Returns for week ending 10-16.

Monday, October 19, 2009

Tuesday's call

the call is to switch short if the adre closes above 44.18.

I will trade the emerging markets at 1.5x.

I will trade the emerging markets at 1.5x.

Friday, October 16, 2009

Thursday, October 15, 2009

Friday's call.

The call is to stay long if the adre closes above 43.79.

I will trade emerging markets at 0.5x

I will trade emerging markets at 0.5x

Wednesday, October 14, 2009

Tuesday, October 13, 2009

Wednesday's call

the call is to say long if the adre closes above 42.57

I will trade the emerging markets at 1.25x

I will trade the emerging markets at 1.25x

Monday, October 12, 2009

Tuesday's call

The call is to switch short if the adre closes between 42.09 and 42.47.

I will trade emerging markets at 1.75x.

I will trade emerging markets at 1.75x.

Friday, October 9, 2009

Monday's call 10-12-09

the call is to switch short if the adre closes between 42.28 and 42.36.

I will trade emerging markets at 1.5x.

this week did not go as I would have hoped...pretty much lost what we gained last week.

Everyone enjoy your weekend and hopefully some have Monday off!

Ended up long for Monday.

I will trade emerging markets at 1.5x.

this week did not go as I would have hoped...pretty much lost what we gained last week.

Everyone enjoy your weekend and hopefully some have Monday off!

Ended up long for Monday.

Thursday, October 8, 2009

Wednesday, October 7, 2009

Thursday's Call.

the call is to stay short unless the eem closes below 38.94.

I will trade the emerging markets at 1.75x.

I will trade the emerging markets at 1.75x.

Tuesday, October 6, 2009

Monday, October 5, 2009

Returns for week ending 10-02.

Finally had a good week. It was a little hard to follow as the closing prices ended near system switch points, leading me to initiate a new rule (to use the 3:50ET price as the price to judge long or short) if the system depends on that day's closing price for the call. This should make the system much easier to use and not significantly change the returns as only a relatively few days will make the call different than the close. One caveat to that statement is, if strong volatility comes back to the market then I will have to reconsider.

Friday, October 2, 2009

Monday's call 10-05-09

The call is to stay short if the eem closes between 37.53 and 38.63.

I will trade the eem at 1.0x with the 3:50ET price.

I will trade the eem at 1.0x with the 3:50ET price.

Thursday, October 1, 2009

Friday's call.

The call is to switch long if the eem closes below 37.94.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

I will trade emerging markets at 1.5x.

I am going to use the 3:50 price...(i.e. the close of the 3:49 one minute bar) to use as the "trading" closing price. IF the price at 3:50ET is below 37.94 I will switch long.

Using the closing price will also work....a few days, possibly 15 per year, would result in a different call.

Subscribe to:

Comments (Atom)